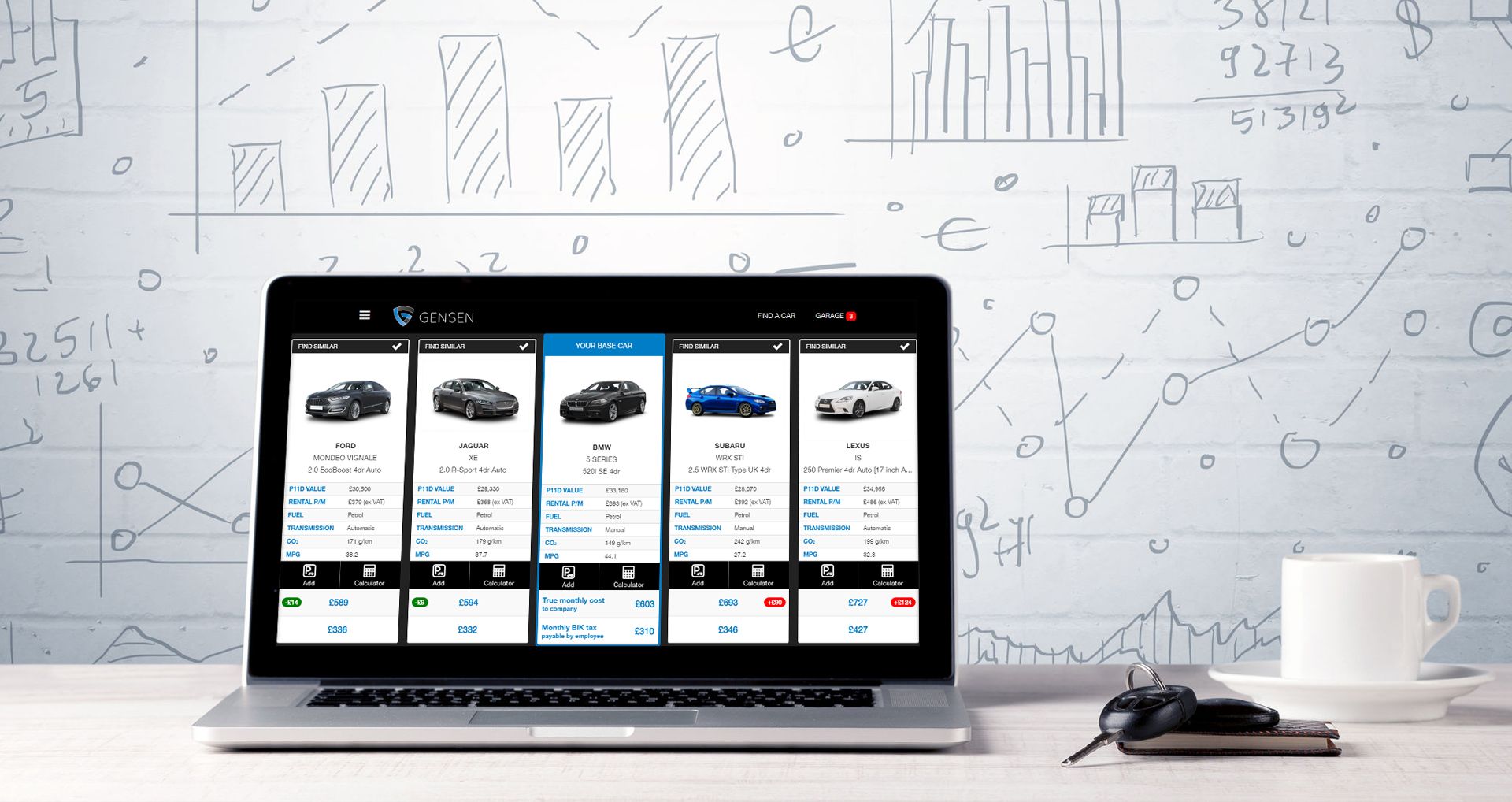

THE Gensen suite of online tax consultancy tools, inceasingly used by brokers and leasing companies for customer consultancy, has been updated to reflect the start of the new tax year and changes introduced in the recent Budget.

BCF Wessex, the software developers behind the Gensen tax calculators, said the latest version accounted for the BIK tax rates that apply until April 2025.

Other changes included the reduced thresholds for capital allowances, which are now reflected in the calculations, as well the reduced lease rental restriction (applicable to cars with CO2 emissions of 50g/km or more).

We have included a new section to enable users to select their corporation tax band and thereby reflect the new, higher rates of corporation tax being introduced from April 2023. We’ve also introduced an ‘exempt’ band which will enable Gensen to be used to support loss making companies and public sector organisations that do not pay corporation tax. In addition, we’ve tweaked the way the reporting feature is accessed from the comparators in readiness for the launch of our new csv reports.

Jeff Whitcombe, director, BCF Wessex

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.