TYPE into your search engine of choice – OK, Google then – and enter salary sacrifice cars. At the latest count there were 13.4m entries about salary sacrifice.

Following the benefit in kind changes in April 2020, salary sacrifice has become widely talked about as a way for drivers to go green by driving electric cars or plug-in hybrids, and for companies to save money.

So it’s quite likely that one of your business customers will come to you asking if this thing called salary sacrifice is worth investigating.

Your answer is, of course, yes!

And you explain to them how their employees could sacrifice part of their gross salary – ie before any income tax or National Insurance Contributions (NIC) are taken – in exchange for a brand new, tax effective electric car (EV) or plug-in hybrid electric vehicle (PHEV) as both work. Although they will be subject to BiK tax on their chosen vehicle, this is so low it’s far more cost effective than taking out a Personal Contract Hire (PCH) agreement.

So far so good.

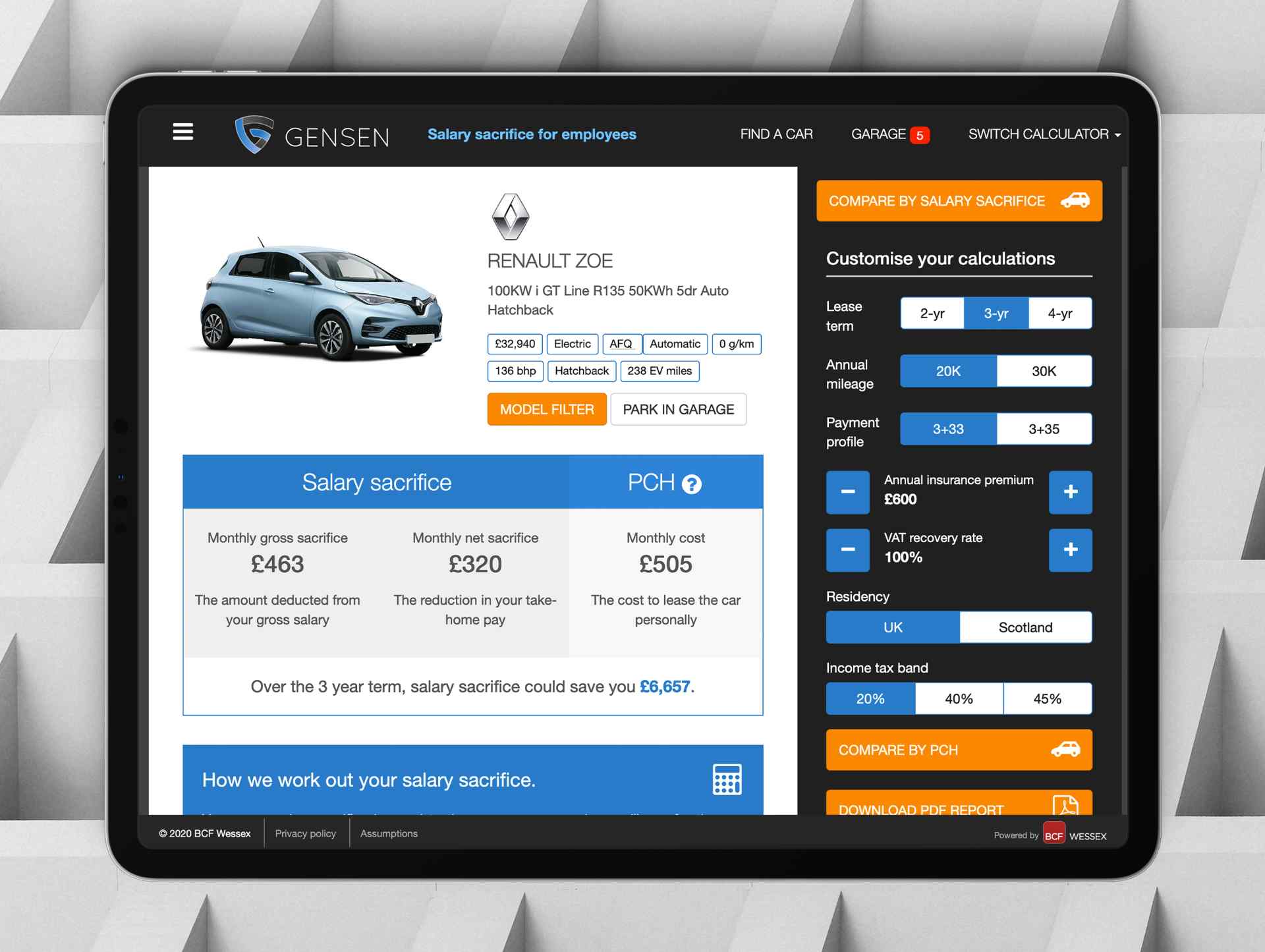

But now you need to demonstrate the savings – both for the driver and the company. There are several calculators that you can use, but we’ve used the new Gensen salary sacrifice calculator developed by tax and finance specialists BCF Wessex.

Let’s see how salary sacrifice would work for a 20% tax payer choosing the popular all-electric Renault Zoe.

Renault Zoe – salary sacrifice for a 20% tax payer

Example – Renault Zoe 100kW i GT Line R135 50kWh

| Employee | |

| Gross salary sacrificed per month | £462.70 |

| Net salary sacrificed per month | £320.12 |

| Monthly cost on a PCH | £505.03 |

| Employee saves over 3 years | £6,656.76 |

| Employer | |

| Monthly NI saving | £60.06 |

| Employer saves over 3 years | £2,162.16 |

Source: Gensen, based on 3+33 profile, 20,000 miles per annum, fully inclusive of maintenance and insurance.

Meanwhile, the employer saves around £60 a month or £2,162 over the three year term – a significant saving. So salary sacrifice offers wins all round.

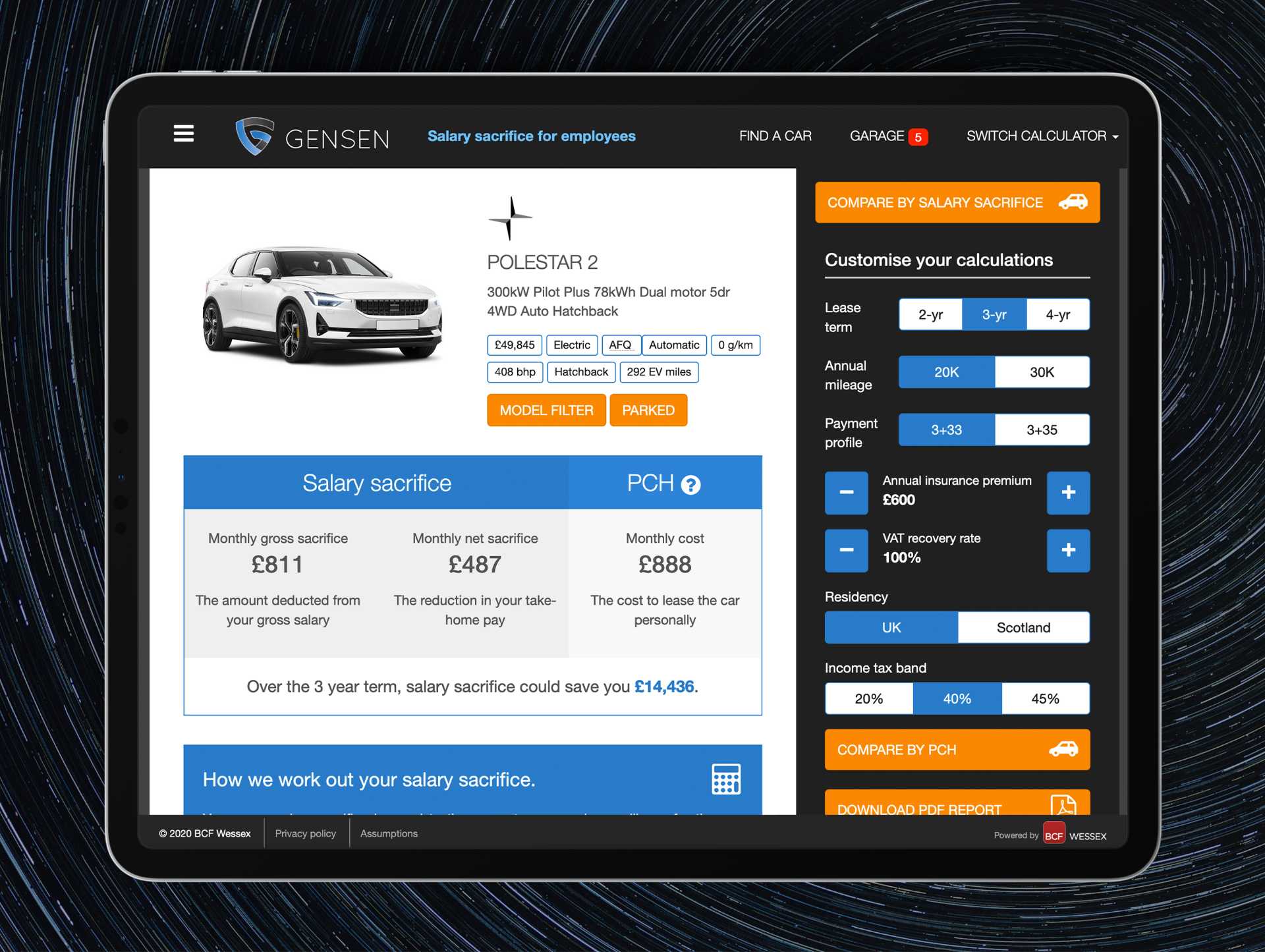

Polestar 2 – salary sacrifice for a 40% tax payer

If we move up to the 40% tax band for a higher earner we can now see the significant changes that such a tax saving arrangement can make. In this example we’ve used the new to market model from Volvo sister brand – the Polestar 2.

Hugely desirable, this executive electric hatchback offers a range of nearly 300 miles on a charge with a 300kW (408bhp) motor and four-wheel drive security. How does it work out for the 40% tax payer?

Example – Polestar 2 300kW Pilot Plus 78kWh dual motor 4WD

| Employee | |

| Gross salary sacrificed per month | £811.00 |

| Net salary sacrificed per month | £486.99 |

| Monthly cost on a PCH | £887.98 |

| Employee saves over 3 years | £14,435.64 |

| Employer | |

| Monthly NI saving | £106.19 |

| Employer saves over 3 years | £3,822.84 |

Source: Gensen, based on 3+33 profile, 20,000 miles per annum, fully inclusive of maintenance and insurance.

As we can see, the savings are considerable for an executive that is already opted out of the company car. Life cycle savings are in excess of £14,000 compared with a traditional PCH. Meanwhile, the employer saves nearly £4,000 in NIC. So again salary sacrifice offers demonstrable all-round savings.

What other reasons make salary sacrifice so attractive?

One of the obvious benefits of salary sacrifice is that every staff member has access to vehicles at fleet discounts – unlike a company car scheme with its restricted staff availability, with salary sacrifice everyone in the business can benefit. It also helps start the process of reducing the grey fleet element within a company, while providing greener vehicles that are fully maintained and insured.

There are also some more immediate reasons for you to consult with business customers about moving to salary sacrifice.

Consideration should be given to the increasing predominance of companies adopting home-working, whether complete or partial, with a reduction in mileage that necessarily entails. This plays well to EVs where range may still be considered a deterrent as long as appropriate home charging can be installed.

Salary sacrifice can also provide an uplift to employees’ take home pay in a time of increasing restraint when pay rises are off the agenda as companies frugally manage resources. Without costing employers more money, the employee’s take-home pay can be made to go further, giving them an effective pay rise without costing the employer a penny. Additionally, it frees up employees’ personal credit lines.

There are some risks to ponder. For example, early termination fees are a consideration. Depending on the funder these may be included in the package. Alternatively, the employer could provision the NIC savings against such an eventuality or recharge some of the employees’ savings against any premium charged by the funder for such an insurance. Given the level of savings available, whichever option is chosen it’s still a win-win outcome.

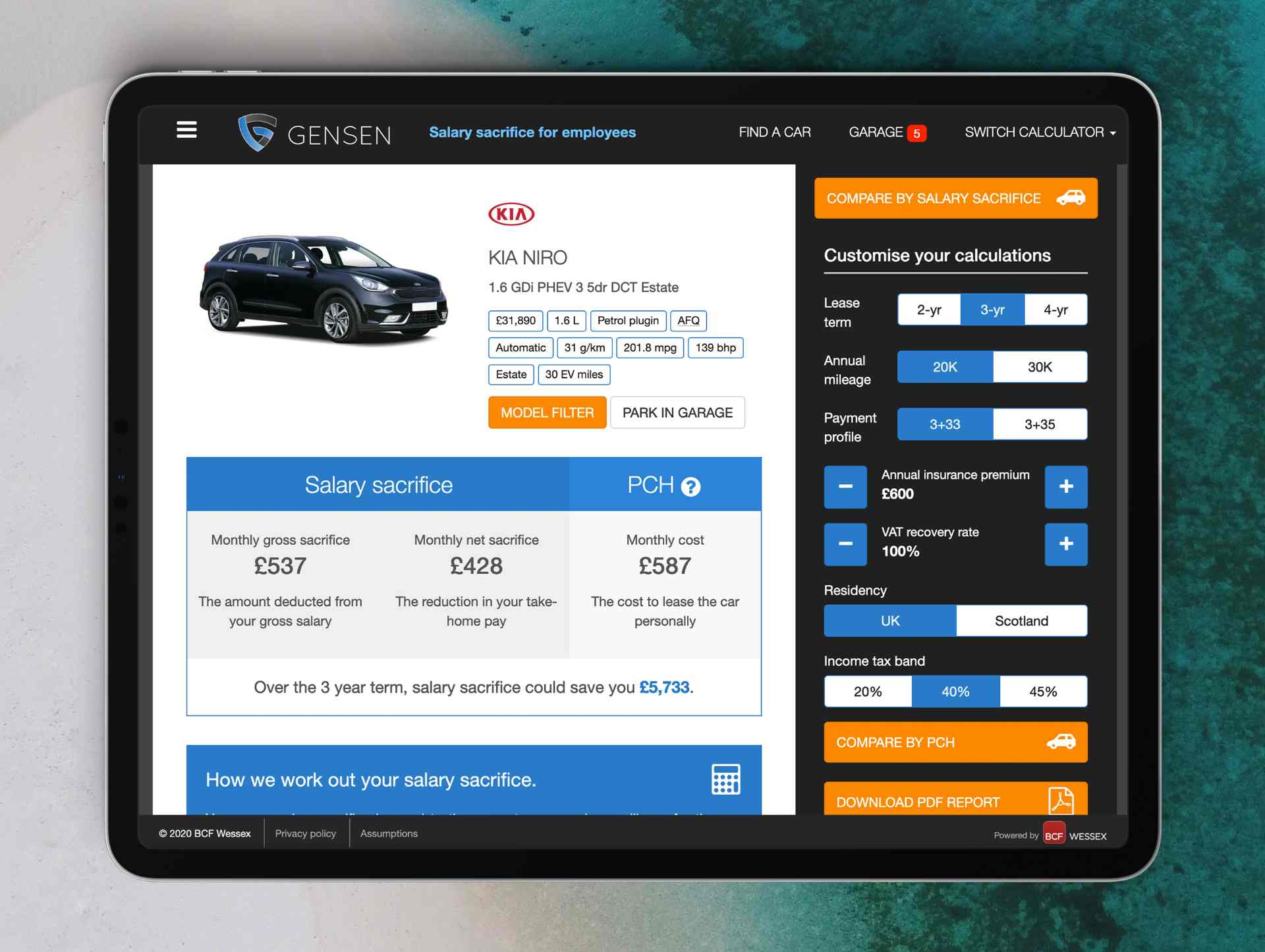

Does salary sacrifice work for PHEVs?

While not all companies will be ready or willing to take the full step to EV, or their employees might be nervous about range issues, then ultra low emission PHEVs also generate savings via salary sacrifice. And you can demonstrate it to clients with a variety of examples.

In this instance we have chosen the Kia Niro for the 20% tax payer and the Audi A6 PHEV for the 40% tax payer.

Kia Niro – salary sacrifice for a 20% tax payer

Example – Kia Niro 1.6 GDi PHEV 3

| Employee | |

| Gross salary sacrificed per month | £536.55 |

| Net salary sacrificed per month | £423.32 |

| Monthly cost on a PCH | £587.37 |

| Employee saves over 3 years | £5,905.80 |

| Employer | |

| Monthly NI saving | £33.70 |

| Employer saves over 3 years | £1,213.20 |

Source: Gensen, based on 3+33 profile, 20,000 miles per annum, fully inclusive of maintenance and insurance.

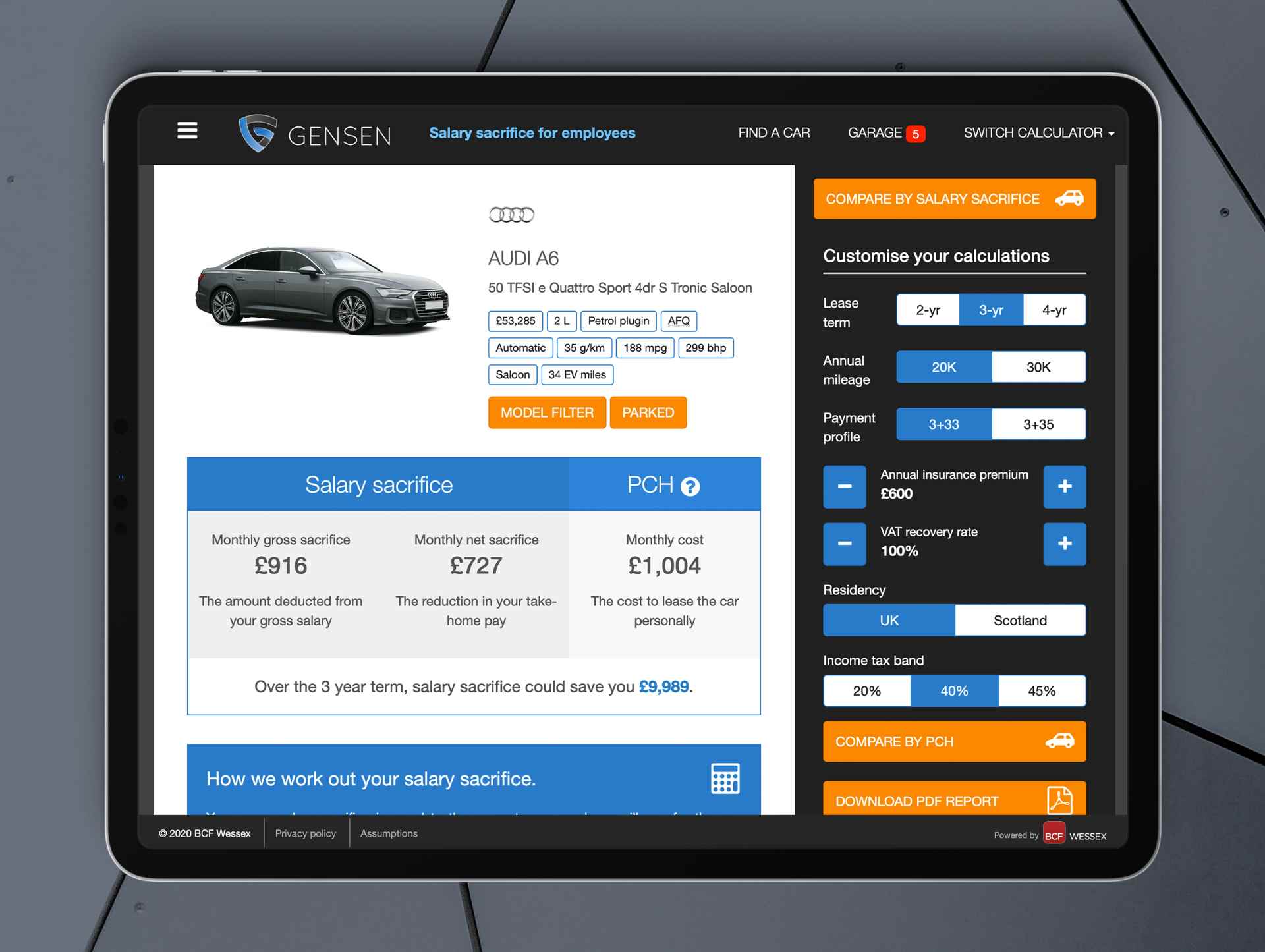

Audi A6 – salary sacrifice for a 40% tax payer

Example – Audi A6 50 TFSI e Quattro Sport S tronic

| Employee | |

| Gross salary sacrificed per month | £916.16 |

| Net salary sacrificed per month | £720.68 |

| Monthly cost on a PCH | £1,004.22 |

| Employee saves over 3 years | £10,207.44 |

| Employer | |

| Monthly NI saving | £59.02 |

| Employer saves over 3 years | £2,124.72 |

Source: Gensen, based on 3+33 profile, 20,000 miles per annum, fully inclusive of maintenance and insurance.

In both our examples, there are still worthwhile savings on offer for both basic and higher rate tax payers as well as worthwhile NIC savings for the employer that would make a real difference to baseline line profitability.

Conclusion

Clearly, then, not only is there a real buzz around salary sacrifice, but there’s good reason why companies are interested in salary sacrifice as our examples have demonstrated.

There are cost and tax savings, a positive CRS image boost with greener vehicles, and the de-risking of fleets with the ability for staff to move from grey fleet to business managed vehicle.

So salary sacrifice is an area of the market offering plenty of potential business opportunities. Now it’s a question of how well positioned brokers are to take advantage of the interest in salary sacrifice.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.