HYBRIDS have had something of a reprieve lately: hybrids were originally believed to be part of the on-sale cull of petrol and diesel vehicles brought forward to 2030. However, the recent government 10 Point Plan to decarbonise the UK still bans petrol and diesel cars from that date, but hybrid vehicles will be allowed to continue until 2035.

Admittedly there is still some clarification required on what is considered to be an ability to “drive a significant distance with no carbon coming out of the tailpipe”, according to Prime Minister Boris Johnson, but nevertheless the hybrid vehicle is with us for longer than we had anticipated.

Which is a good thing. The self-charging hybrid, and especially the plug-in hybrid (PHEV), have much to offer drivers unsure of the big step into zero emission electric vehicles.

And new technology developments are starting to be unveiled at a rapid rate. Renault has a new range of Formula 1 derived E-TECH technology covering both hybrids and plug-in hybrids, while Nissan has e-Power for its new Qashqai which provides electric only driving, with the battery kept charged by a small petrol engine that acts as a battery generator.

Clearly, what we think of as hybrid technology today will be very different from the hybrid technology of tomorrow.

But what is the best hybrid technology for your business clients?

That’s a good question, and to a certain extent may be controlled by the actual requirements of the business. That aside, as a broker if you are consulting on what is the best technology, how do you establish which is the most cost-effective for the business, and the employee?

Hybrids tend to have a lower list price so rentals are consequently more competitive than they are for a similar plug-in hybrid model. But is that the case over the whole life cost? And would drivers be better off in a PHEV? Let’s have a look at various scenarios with help of the BCF Wessex created Gensen calculators.

Executive saloons – hybrid versus PHEV

We’ll keep our focus on executive type saloons to ensure we’re looking at comparable vehicles. There are some key issues to be overcome with your business clients, particularly around the upfront monthly rental.

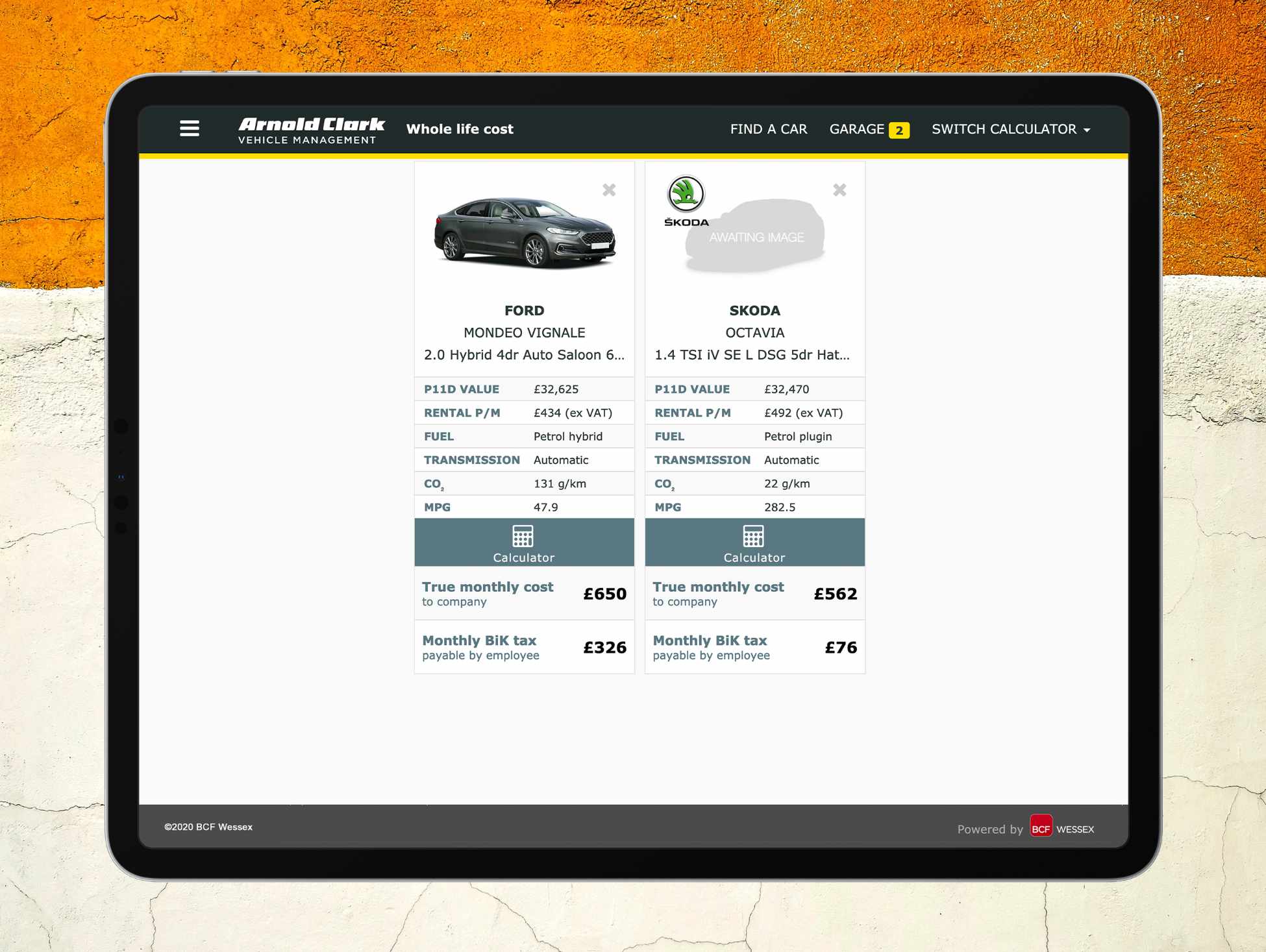

Mondeo Hybrid v Octavia PHEV

For example, we have the Ford Mondeo Vignale Hybrid with a P11D of £32,625 and a monthly rental of £434. At a similar P11D is the Skoda Octavia iV, the company’s new plug-in hybrid. But it’s monthly rental is £58 extra a month. So does the business go for the ‘cheaper’ Mondeo or the ‘more expensive’ Octavia?

You need to move clients past the headline figures and delve deeper into the whole life costs of the vehicles, looking at the total cost of the rental, maintenance, fuel, insurance and Class 1A NIC minus any VAT reductions and tax relief, as well as considering the impact on the driver’s benefit in kind to find the most appropriate answer.

While the Mondeo has a respectable 47.9mpg this bumps up its overall running costs to make it nearly £100 a month more in whole life costs. Now, it’s true, you need to get drivers to use the zero emission capability of their PHEVs as much as possible, so the near 300mpg of the Octavia will not be so attainable in everyday life. Nevertheless, it’s unlikely to be £100 extra to bridge the gap to the Mondeo costs.

But the really telling area comes when we look at the driver’s BIK: with the Octavia’s 22g/km CO2 emissions and 41 mile zero emission range, its taxation treatment is highly benign at £76 a month against the Mondeo’s £326 a month – more than four times that of the Octavia’s BIK.

The taxation system really does play to the PHEV’s strengths, and with the stronger running costs and significantly better driver BIK, the Octavia is clearly the better business choice.

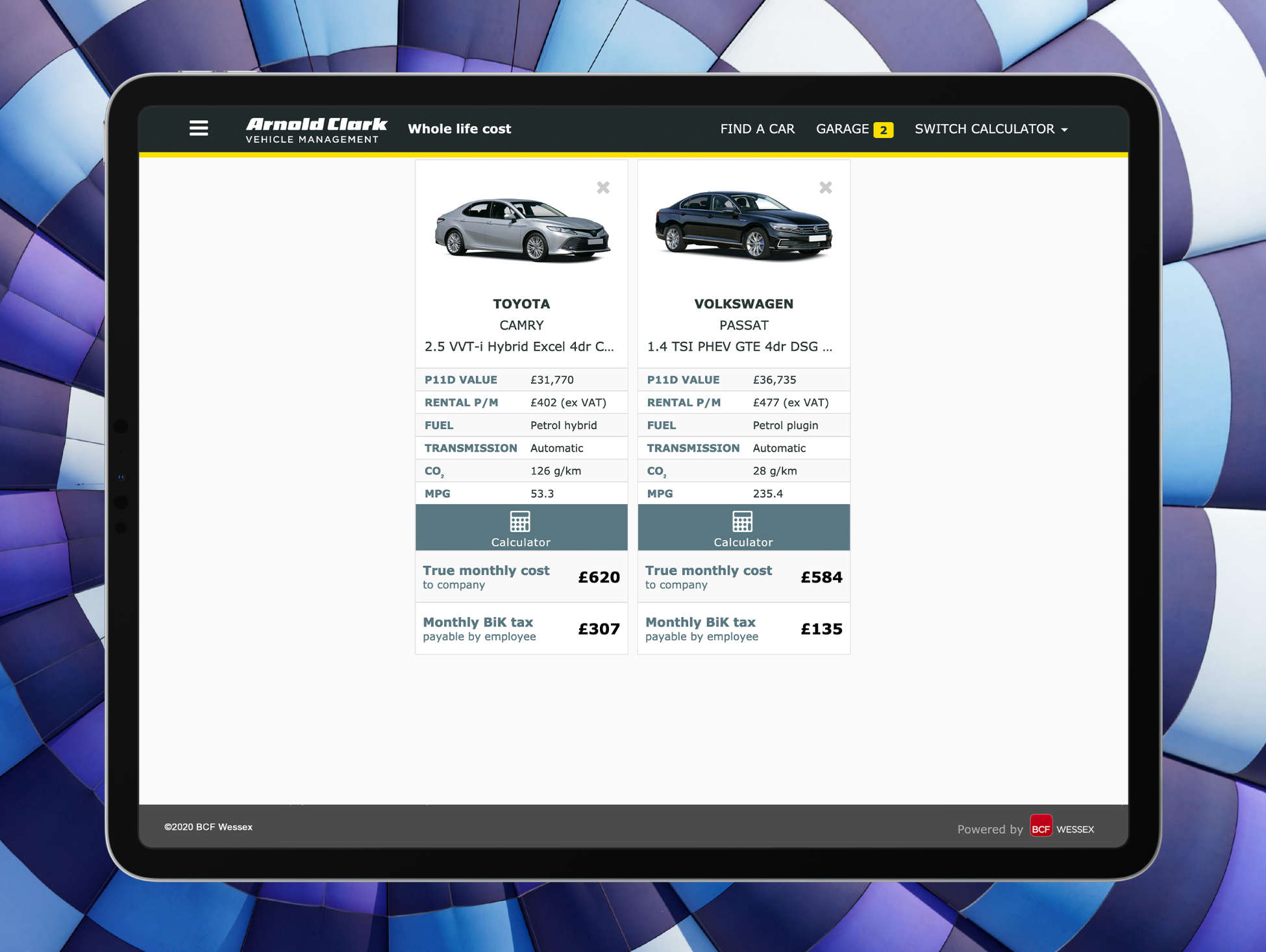

Camry v Passat

The Toyota Camry returns to the UK market with a hybrid option to make it more appealing to fleets. Well specified to meet the demands of executive drivers, the rental is a really impressive £402 a month, while there’s over 50mpg from its hybrid drivetrain.

The Passat PHEV looks positively expensive against the Toyota, costing £75 extra a month in rental, but offering lower Class 1A NIC and higher fuel economy, once again those superior running costs come into play. The result? It’s £36 a month cheaper than the Camry in overall running costs.

To be fair to the Toyota, those fuel costs of the Passat, which if not met, would make the Camry a contender – until you consider the driver is paying less than half the amount of BIK compared with the Camry. Once again the decision goes to the PHEV.

ES v 3 Series

A similar story plays out here. The upmarket luxury Lexus, cousin to the Camry, offers a decent rental and good fuel economy for such a large car, but the 330e’s 200+mpg is the killer in the equation making it over £90 cheaper to run every month when fuel economy and Class 1A NIC are taken in to account. The real clincher though is the BMW’s driver BIK, saving the driver £174 a month against the Lexus.

Making the PHEV decision work with a fuel policy

While the running costs work out on the calculator in favour of PHEVs, plug-ins have come in for a considerable amount of stick from critics, suggesting that the combined CO2 and fuel savings are rarely achieved in real life.

This, however, isn’t the fault of the technology so much, it’s more a question of driver behaviour.

So how do you modify that behaviour if you are suggesting a client’s fleet takes a PHEV for all the very good reasons we’ve outlined above? The answer, here, is to consider the fleet management of the vehicle in terms of how business mileage is paid and how private mileage is reclaimed.

While there are HMRC approved fuel reimbursement rates for petrol and diesel cars – the Advisory Fuel Rates (AFRs) – to enable fuel to be reclaimed without the driver incurring a fuel benefit tax charge, and there is a rate for electric cars – the Advisory Electric Rate (AER) – there is none for PHEVs.

While paying drivers of PHEVs at the full AFR could be seen as ‘generous’ by the company, it also doesn’t encourage drivers to use the electric only facility of the car.

So many fleet fuel experts suggest a ‘hybrid’ approach, either where the first 25 miles of any journey are paid at the AER for a blanket approach before reverting to the AFR, or for a more detailed approach the individual vehicle’s actual zero mileage capability – 32 miles, 45 miles or so on – is taken into account for each trip, and the AER is paid on that capability before the AFR kicks in.

Such an approach encourages drivers to make full use of the electric-only capability of the PHEVs, so businesses actually realise the expected running costs of PHEVs.

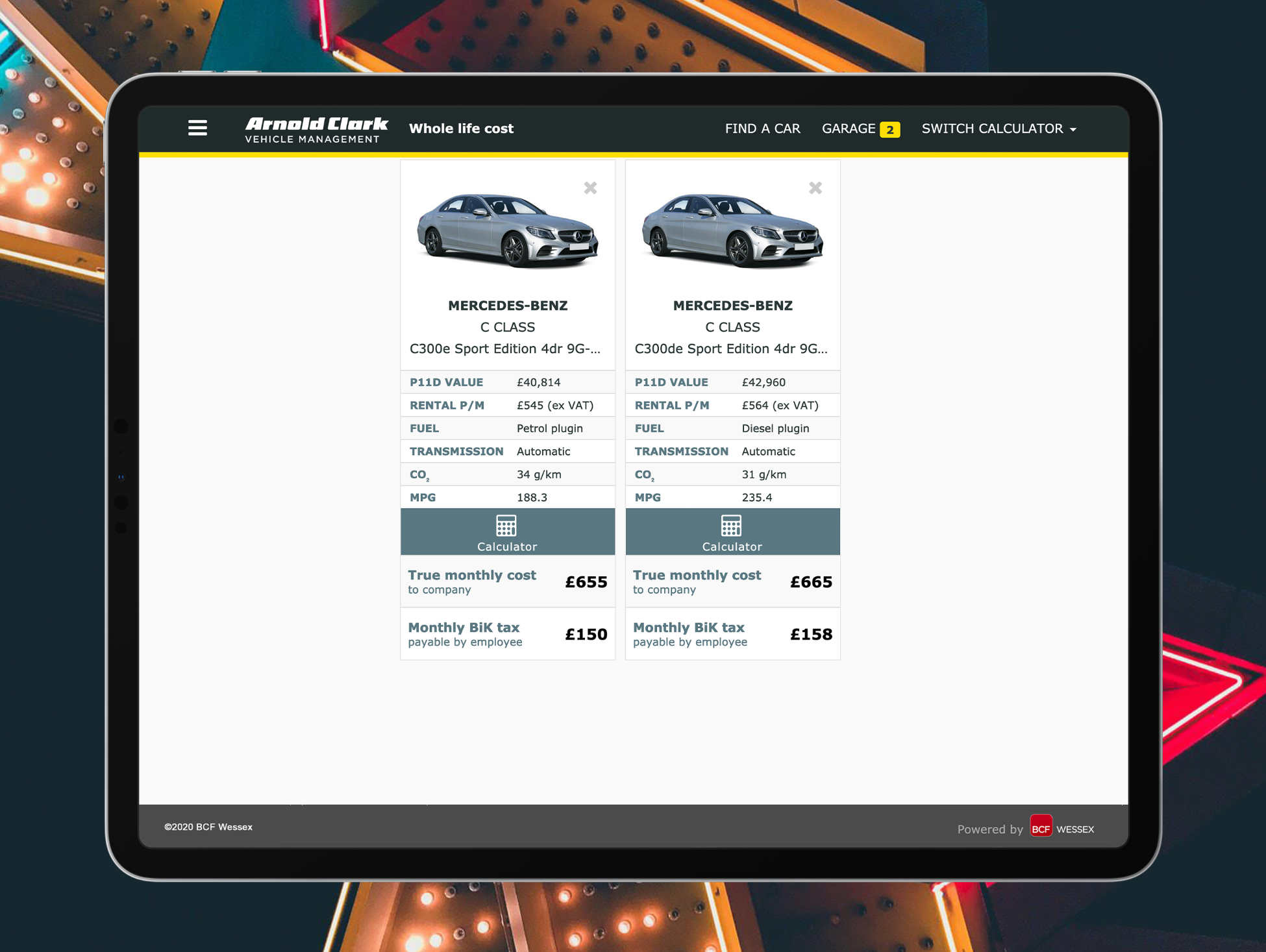

What about petrol PHEV v diesel PHEV?

Most PHEVs are petrol plug-in models. But Mercedes also offers the choice of a diesel PHEV.

While you might have thought the diesel’s better fuel economy would make it the appropriate choice, its greater list price and higher rental play against it in overall costs. The petrol is better by £10 a month. And that greater P11D of the diesel hybrid also makes an impact on the driver’s BIK tax, being £8 a month more than its petrol equivalent.

So in this case, the right choice would be the petrol PHEV C Class. But only by analysing the figures with calculators such as Gensen can you dig down into the finer detail to overturn presumptions.

Conclusion to hybrids v PHEVs for business

Hybrids are, increasingly, going to be talked about by fleets and quite rightly, too, as more and more technology comes into the marketplace – the question is: can you advise fleets correctly on the right choices for their fleet? Can you provide the correct whole life cost data? And can you provide the fleet management expertise to ensure the savings you suggest are realised?

Business contract hire may be unregulated business, but the central tenet of broker business – treating customers fairly – still holds. So it’s critical to have the right tools at your disposal to demonstrate your expertise in fleet management. Correctly.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.