THERE’S been little distraction from the media headlines on the cost of living crisis – excepting the antics at the House of Commons, of course – but with electric costs on the rise, many are questioning whether it’s better to stay with a conventionally fuelled vehicle – petrol or diesel and also referred to as an ICE (Internal Combustion Engine) – or move towards electric vehicles (EVs).

Certainly the momentum is with EVs, as more and more company car drivers and salary sacrifice takers switch from ICE to EV.

Electric cars took 16.9% of the market in September according to SMMT data with 14.5% market share year-on-year – an increase of over 40%. So there’s little doubt abourt the direction of travel.

It’s helped of course by the tax breaks for business use. So even though EVs command usually higher P11D values and more expensive lease rentals compared with petrol or diesel counterparts, those tax incentives and the cost of fuel tends to mean EVs have lower whole life costs (WLC).

But is it still true in the current economic climate?

With electricity prices rising – both for domestic home charging and at public chargers – and the cost of petrol and diesel falling, how has the comparison changed? Are clients challenging you on the overall equation?

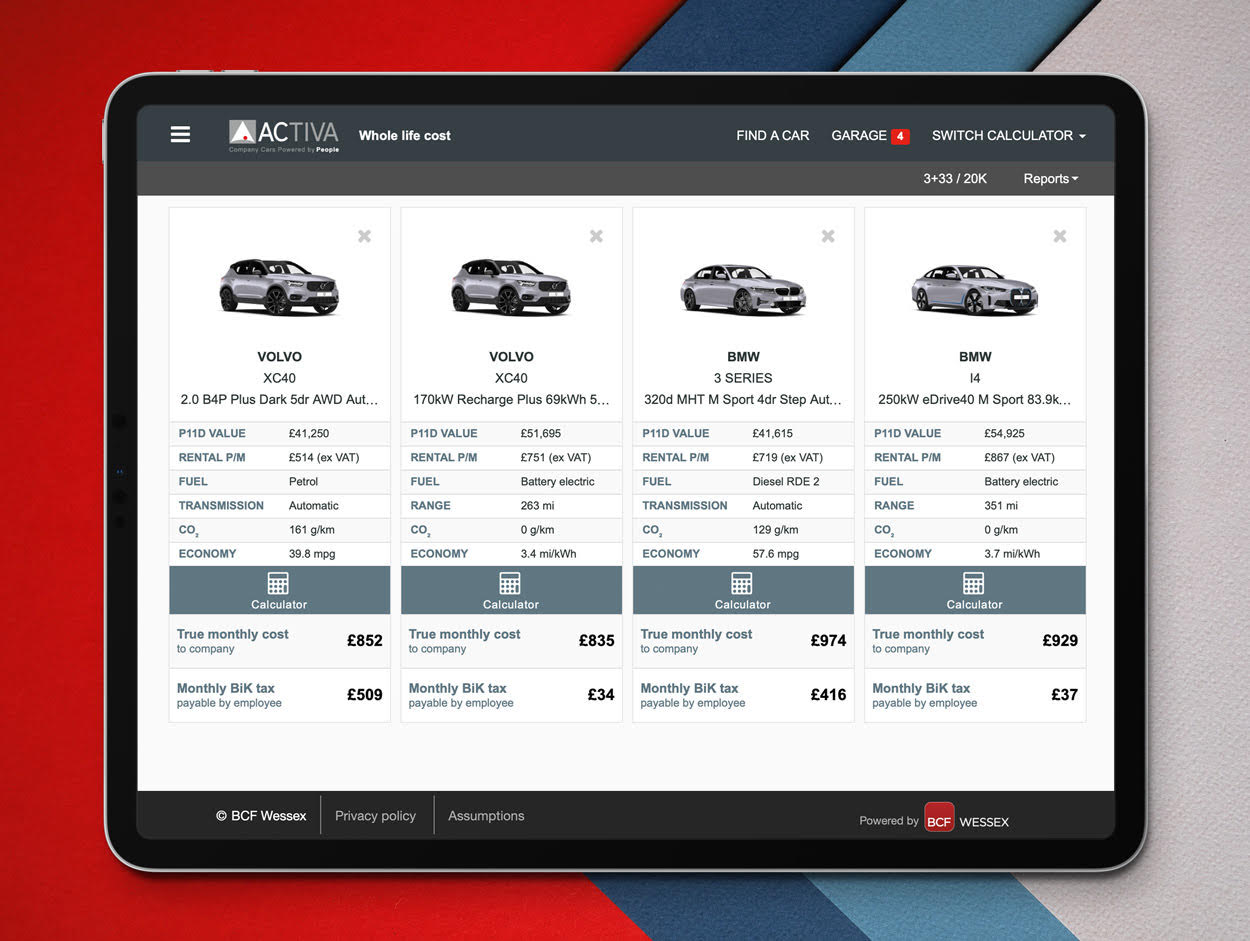

To assess what’s changed, we’re going to use the Gensen software suite of calculators to examine if the balance has tipped back towards ICE vehicles on WLC across a number of different fleet scenarios.

For comparison purposes we’ll use:

Volvo XC40 petrol SUV versus Volvo XC40 EV

- P11D differential = £10,455; monthly rental differential = £237.

BMW 3 Series M Sport diesel versus BMW i4 EV

- P11D differential = £13,310; monthly rental differential = £148.

Understanding the costs using AFRs and AERs

Although there’s widespread discontent with the way in which the Advisory Electric Rate (AER) is calculated, let’s compare the costs assuming petrol and diesel expenses are reimbursed using the Advisory Fuel Rates (AFRs) and electric charging costs are reimbursed using AERs.

It’s as we expected: the EVs have lower WLCs than their ICE counterparts despite the higher base costs. The Volvo has a £42 monthly advantage, while the BMW has an £83 advantage. And in terms of driver company car tax, the EVs are streets ahead.

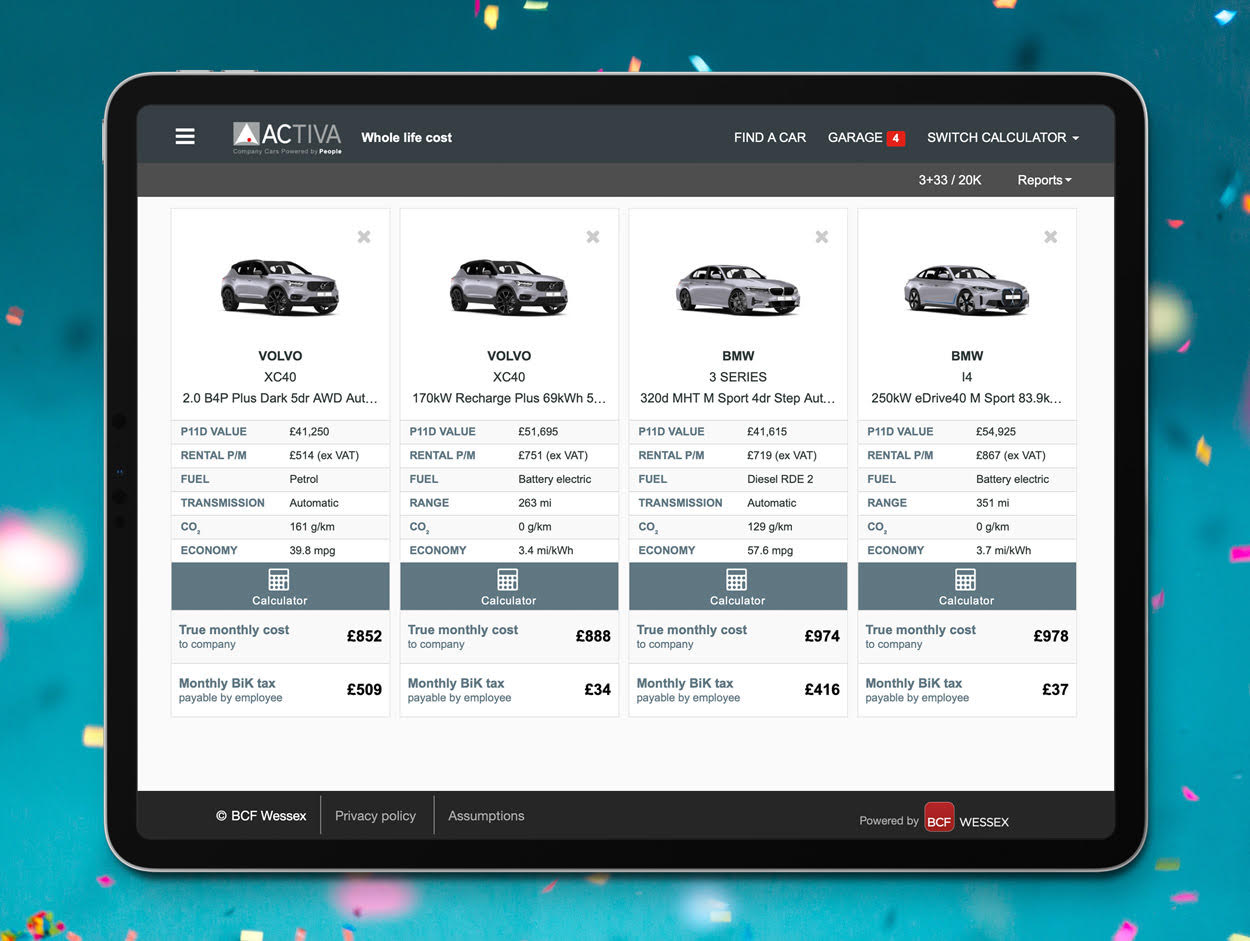

What if we do the comparison using home charging costs?

Most EVs are charged at home, so it’s important to examine the cost differential using home charging costs.

With the Energy Price Guarantee fixing unit electricity costs at 34p/kWh and using the latest price of petrol (£1.62) and diesel (£1.81) published by the Department for Business, Energy & Industrial Strategy (10/10/22) we see that the EVs are still both cheaper but the differential has fallen.

The electric Volvo is now only £17 a month ahead of its petrol counterpart, while the BMW i4’s advantage drops to £45. But both the EVs remain the business choice for fleets.

Home charging is one thing – and fleets try to encourage the use of home charging as much as possible – but fleet EVs will need to be charged up on the road if they are going to be effective company cars.

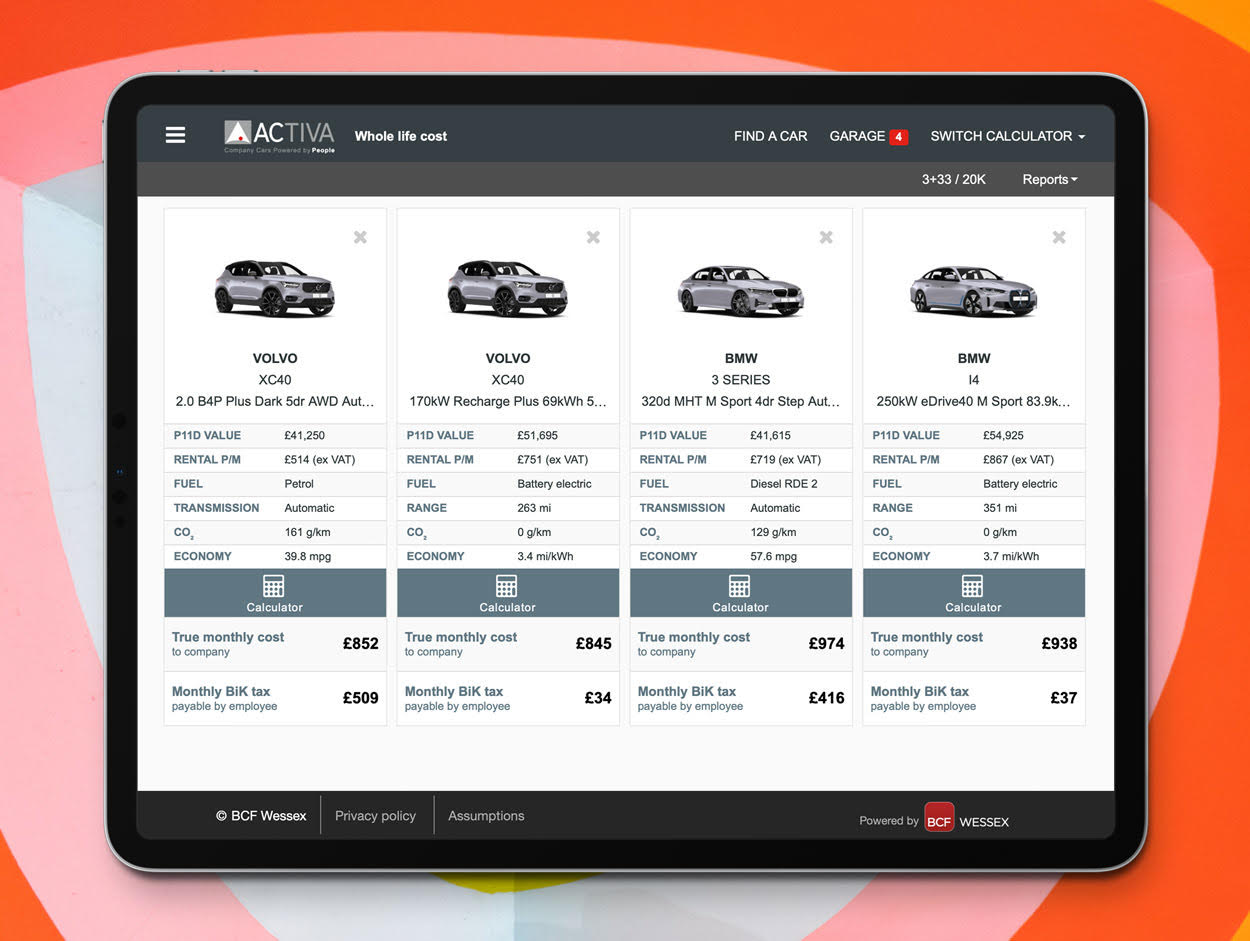

Comparing the costs using on the road charging

EV chargepoint map finder, Zap-Map, recently ranked charging networks by user experience. Both InstaVolt and Gridserve were in the top six, but both are now offering charging at 66p/kWh.

How does this impact the equation?

Those public charging costs and the convenience of rapid charging come at a cost and put both the EVs on a more expensive WLC footing than their ICE equivalents.

In particular, the Volvo XC40 EV is now notably more expensive – by £36 – for the fleet operator (bear in mind that it’s a significantly more expensive car to lease and a cheaper model is available) but the BMW i4 remains blow-for-blow highly competitive with the diesel 3 Series with just £4 in it.

So what’s the conclusion? Is EV still better for fleet customers than ICE?

With the cost of electricity having risen substantially, the dynamic is different compared with last year and the year before, with the comparisons being much closer.

So your customers are right to challenge you on this, but it should be borne in mind that:

- while the cost of fuel has fallen recently it too is much higher than last year, and it’s increasing again given OPEC’s recent decision to cut oil production; and

- drivers will use a variety of chargers some of which will be free, say at the supermarket; so

- taking a blended cost of electricity of 40p/kWh (assuming 20% free, 40% at home and on the road):-

- the costs of the Volvos are broadly comparable; and

- the BMW i4 is notably cheaper than its diesel counterpart.

And, of course, there’s the driver benefit in kind taxation to consider – which we mentioned earlier. EVs are significantly cheaper for drivers, so there are likely HR implications should a business remain ICE based on almost comparable running costs, not to mention the Environment, Social and Governance (ESG) implications for the business.

And, anyway, there’s always a deal to be done via a trade up or private use contribution to ensure the employer is not out of the pocket if the driver really wants to maximise the tax efficiency and switch to electric.

So, how can I make comparisons like these ICE v EV calculations?

- It’s simple really; the answer is Gensen

- Gensen is a suite of WLC calculators and comparators designed to make the complex simple

- It’s a point of sale toolkit that allows you to do calculations like this in minutes, while sitting across the desk from your client, or live on a video conference call

- But with its enhanced csv reports and a multirate book option that allows you to load customer specific rates

- It now enables you to perform more detailed work too, helping you put together a fleet policy for your customer and undertake regular reviews

For more information contact: 0141 280 2020 | info@bcfwessex.co.uk

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.