CASH: I’m not sure the last time I actually used ‘physical money’ since the pandemic started in March, preferring contactless card transactions delivered digitally and securely, rather than notes touched by humans.

But cash still has a role to play in company car provision, whether that’s a company car, salary sacrifice car or a cash alternative. Provision of a car remains an integral part of an employee’s benefit package and is important in retaining qualified staff.

Offering an employee cash is a relatively simple way to navigate the conflicting attentions of the move to WLTP emissions, changes to benefit in kind taxation and fleet disruption caused by working from home during the COVID-19 pandemic. A collection of issues that one of your clients might find too daunting.

So cash is an easy get-out clause and can save the employer money and certainly leave the employee in, at best, a neutral position regarding the cost of a personal lease against the combined tax savings and company cash.

But is it the right decision? Are you treating your clients fairly by not investigating a little further? Let’s have a look at what is on offer.

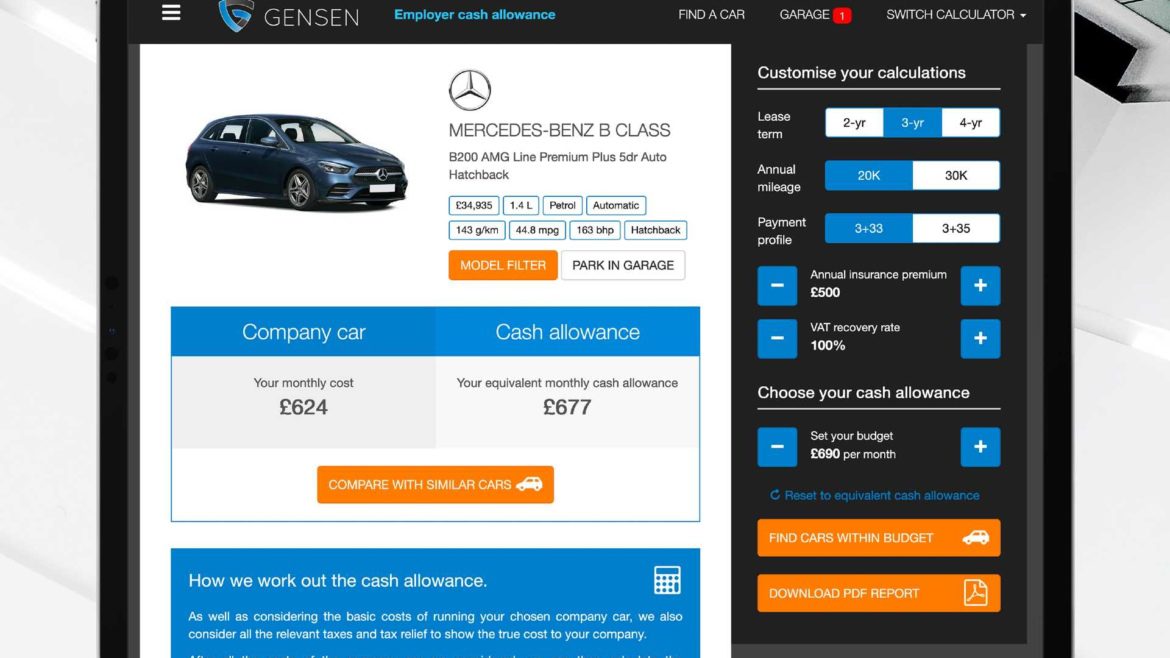

Taking the cash on a Mercedes B-Class

To begin with, we’ll take the example of an employer offering a staffer a Mercedes-Benz B-class. It’s the fancy B200 AMG Line Premium Plus auto model and we can explore a variety of scenarios quickly using Gensen from BCF Wessex with its variety of calculators.

The monthly rental on this Mercedes as a company car is £457 + VAT per month, but the gradual and continual tightening of the company car tax bands means the driver would now pay £373 a month in tax. So the employer has decided that the cash route might be a good idea and provides a gross cash alternative of £677 a month. In this way, the company’s cost is neutral.

Calculations based on a lease with a start date of 6 April 2020 on a 3+33 profile, assuming 10,000 business miles per annum, with an annual insurance premium of £500. Source: Gensen

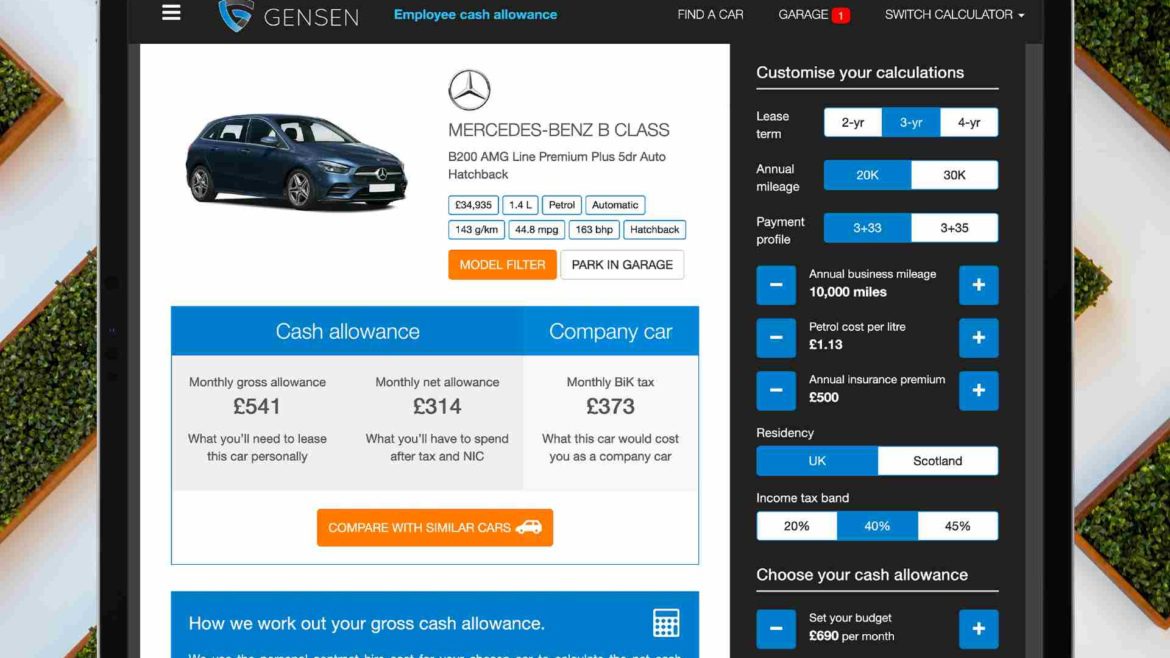

But wait a minute. The employer has forgotten about the tax saving the employee will make by not taking the company car (as we’ve seen, that’s £373 a month for someone in the 40% tax bracket). Taking these BIK savings into account the gross monthly cash alternative can be reduced to £541 which keeps the employee roughly tax neutral. See the below example:

Mercedes B-Class with a cash allowance of £541

Calculations based on a lease with a start date of 6 April 2020 on a 3+33 profile, assuming 10,000 business miles per annum, with an annual insurance premium of £500. Source: Gensen

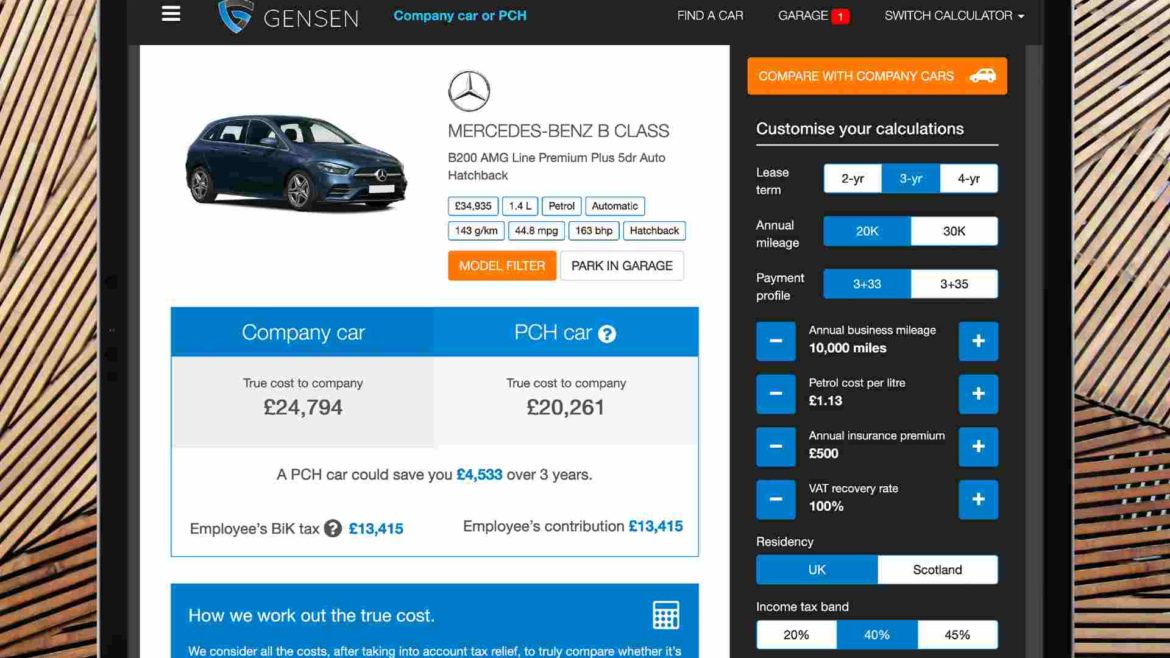

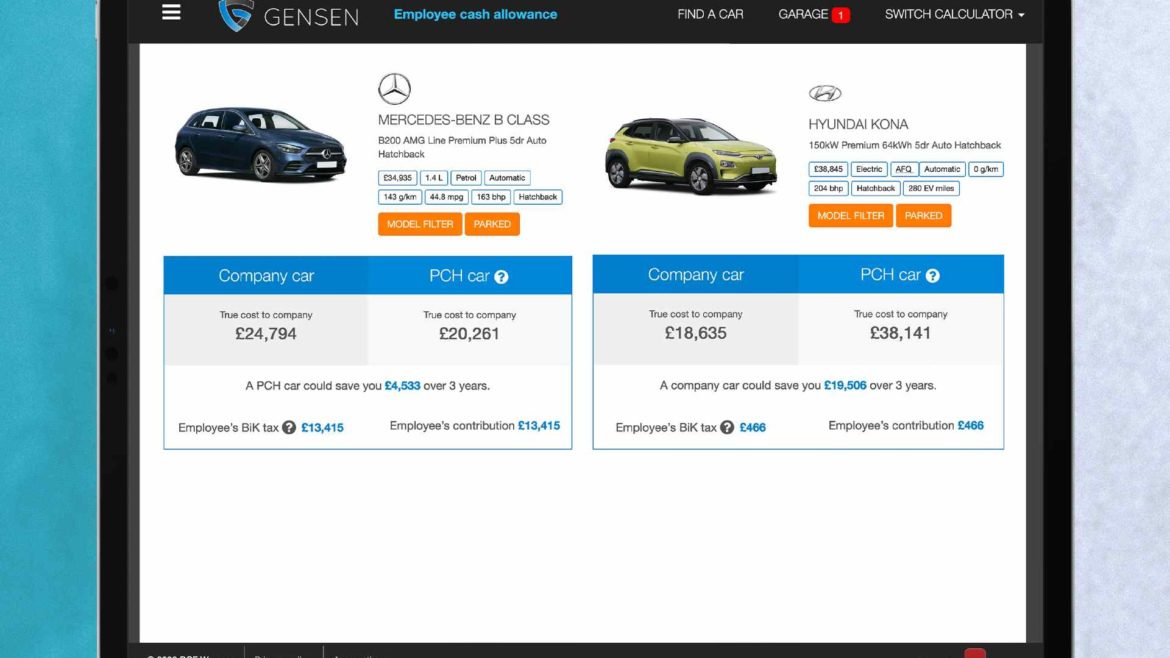

Now, by switching the Gensen calculators to the Company Car v PCH option, the company’s savings are easily demonstrated: by paying the right cash alternative the company could save more than £4500 over the three year term. What’s more, the employee remains in a cost neutral position.

Mercedes B-Class: company car or PCH car

Calculations based on a lease with a start date of 6 April 2020 on a 3+33 profile, assuming 10,000 business miles per annum, with an annual insurance premium of £500. Source: Gensen

What about a greener alternative to offering cash, though?

The new benefit in kind company car taxation system, introduced this April, has required businesses to rethink their car offerings to employees. In particular, it’s left the cash rather than the car equation looking a bit mildewed, yesterday’s thinking for a different set of questions that are irrelevant now. So it’s important that you point out to a client that a company car can be made to work for both employee and employer.

There’s certainly a lot of interest in electric cars, prompted in no small part by the significant tax savings that can be achieved. Broker funder Alphabet recently reported that 25% of respondents to a survey it commissioned, called Fleet Streets, would choose an EV for their next vehicle.

Company car surge in popularity

Alphabet’s research showed 37% of consumers would now consider using a company car following the pandemic, to enable them to travel safely, whereas prior to lockdown many employees favoured a cash benefit. These changes are likely to remain for some time due to ongoing safety concerns and fleet managers will need to have a flexible fleet offering to handle these changing preferences when building their future mobility plans.

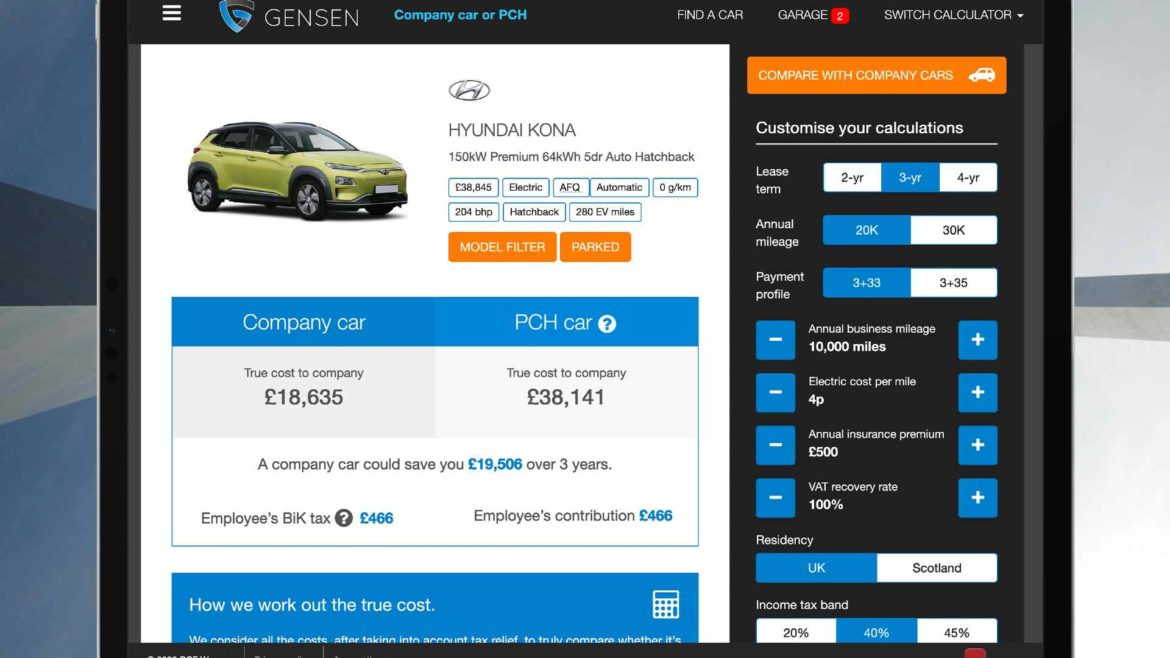

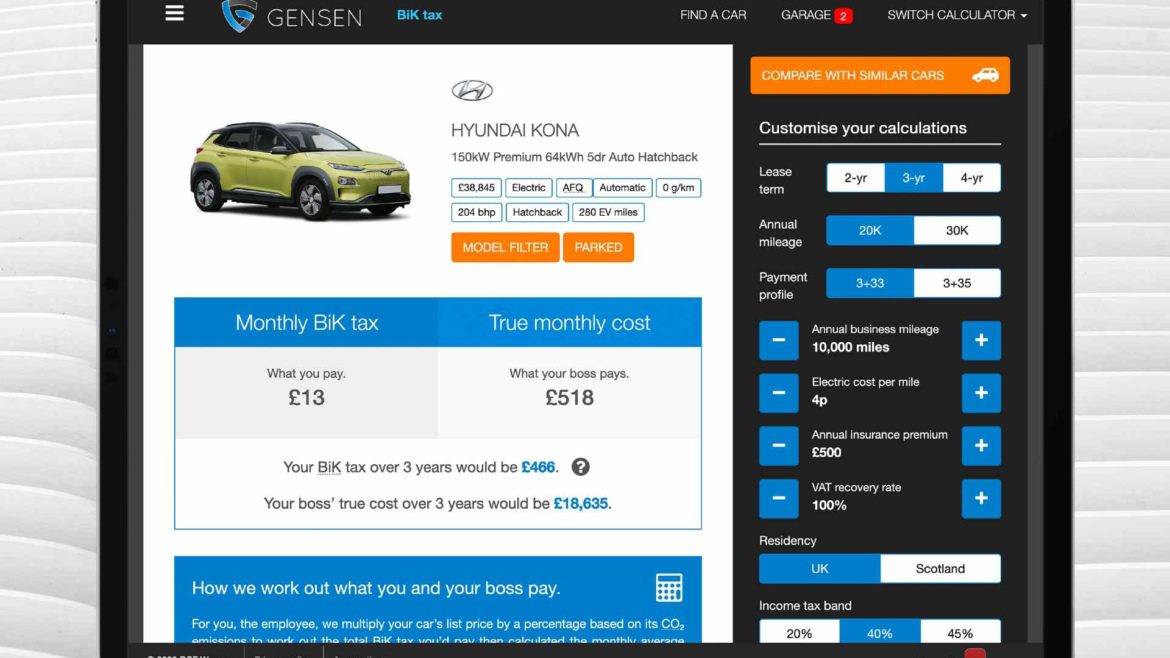

So let’s turn back to the Gensen calculator and have a look at a different car – the zero emission Hyundai Kona 150kW Premium 64kWh auto compact crossover with its 280 mile battery range.

It really doesn’t make sense offered as a cash alternative because the PCH lease rentals would be too high. However, as a company car both the employer and the employee save compared with the Mercedes and the employee saves substantially on tax.

Hyundai Kona EV company car v PCH car compared

Calculations based on a lease with a start date of 6 April 2020 on a 3+33 profile, assuming 10,000 business miles per annum, with an annual insurance premium of £500. Source: Gensen

By offering the employee an electric company car instead of a cash alternative, the benefit in kind saving is immense, costing the staffer just £466 over the three years. The Mercedes would cost the employee £13,415 in BIK.

Comparing the PCH costs to the BCH costs

It’s not all employee gains either. If we just switch back to the employer’s view, the cost of provisioning the Mercedes A-Class on a PCH agreement is £20,261(the figure just below the calculator sign in the image below). However, the cost of providing the electric Kona as a company car is less by £1626 at £18,635, so it’s savings all round (see bottom figure on Kona illustration below the calculator sign).

Calculations based on a lease with a start date of 6 April 2020 on a 3+33 profile, assuming 10,000 business miles per annum, with an annual insurance premium of £500. Source: Gensen

So the answer to the cash versus car question is this: go green.

Combined cost of Hyundai Kona EV is £19,101

Calculations based on a lease with a start date of 6 April 2020 on a 3+33 profile, assuming 10,000 business miles per annum, with an annual insurance premium of £500. Source: Gensen

You can demonstrate the savings simply and make the company car a significantly enhanced retention tool – or enticement – for any employer. And having demonstrated such savings to your client, imagine how many vehicles they will be ordering from you in the future?

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.