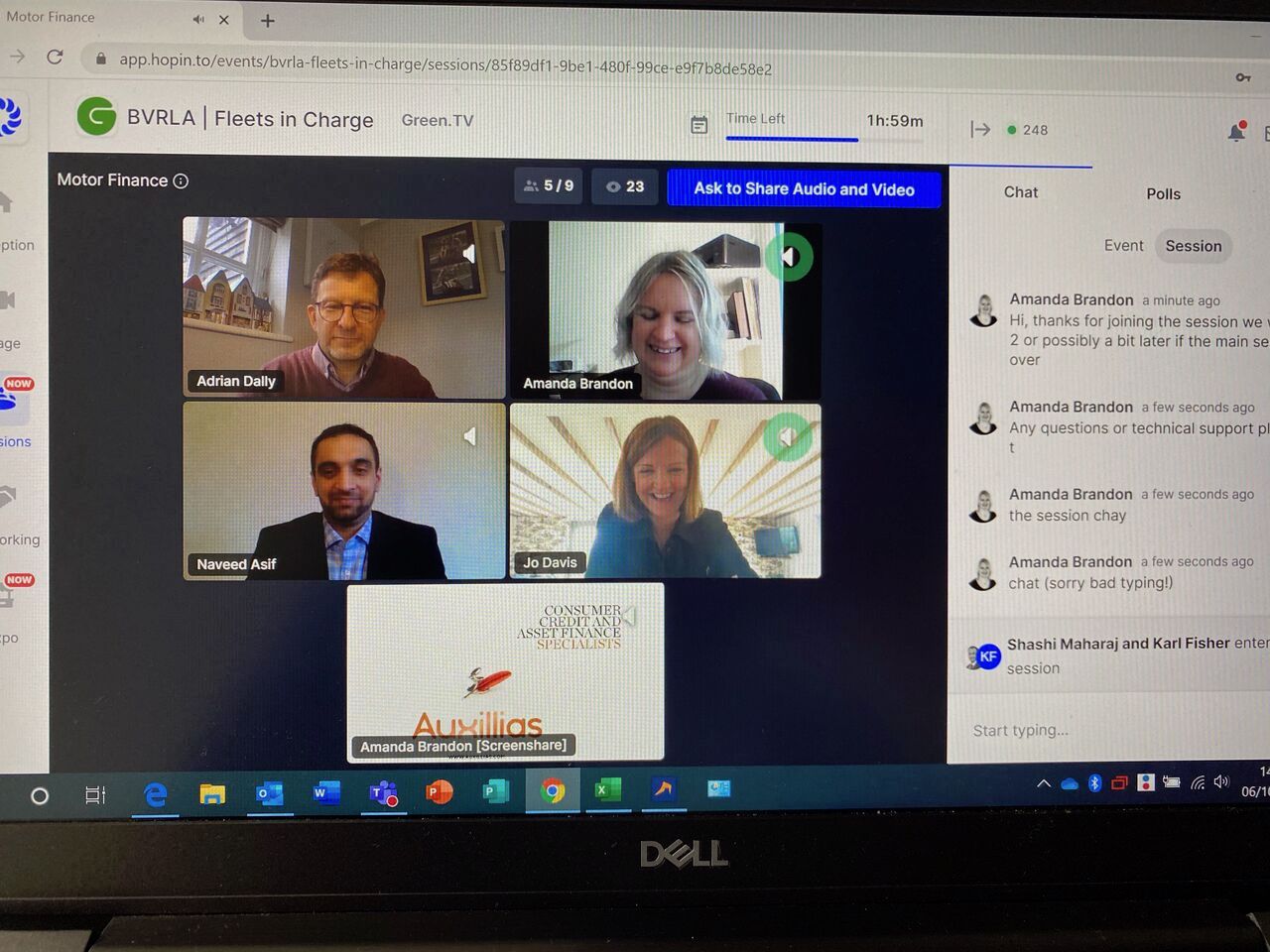

THE Fleets in Charge virtual conference, organised by the BVRLA on 06 October, included a break out session on Motor Finance.

Hosted by Amanda Brandon, BVRLA’s director of fleet services, the presenters were Joanne Davis, a co-founder and partner in Auxillias; Naveed Asif, consumer credit consultant at the Consumer Credit Advisory Services; and Adrian Dally, who is head of motor finance at the Finance and Leasing Association.

SM&CR update and November deadline or £250 fee

Joanne Davis provided an update on the Senior Managers & Certification Regime (SM&CR). She explained that a new report (REP008) needed to be filed to the FCA for firms that had taken disciplinary action for conduct rule breaches against individuals who were not senior managers. Davis said a nil return was required even if there had been no breaches.

The report, which is due by 02 November 2020, covers the period 09/12/19 to 31/08/20. Failure to file will result in a late return fee of £250, she said.

Davis went on to consider vulnerable customers and latest FCA guidance, saying: “Fair treatment of vulnerable customers should be properly embedded in culture policies and processes.”

She provided a ‘to do’ checklist for treating customers fairly:

- Exercise judgement in treating consumers fairly – it should not be a tick-box exercise.

- Look at your culture, policies and processes and how you can demonstrate these processes.

- Deliver staff training – it may not be proportionate to send all staff on vulnerability training courses.

- Set up systems and processes that will support and enable consumers to disclose their needs.

- Consider the needs of vulnerable customers at all stages of product and service design.

- Evaluate your customer journey and respond to the needs of vulnerable consumers at all stages.

- Keep on learning and improving.

Is your sales process right for the customer?

Naveed Asif, from broker auditors CCAS, looked at trends in the auditing of leasing brokers. In particular Asif said there were vast differences in customer facing documents.

“For example, I have seen a broker supply a customer who was going for a PCH agreement sent documentation covering all forms of personal finance. How is that helping the customer? So keep the documentation relevant.”

Asif also questioned the viability of cancellation fees and whether this was treating the customer fairly.

“Many brokers have a figure for cancellation fees, often three months’ rental. But how relevant are these fees? Is it treating the customer fairly? Clearly it’s sometimes fair to pass on the costs to the customer, but I’ve seen examples where the terms and conditions exceeded the finance agreement.”

Other areas Asif considered were complaints management information and when it was relevant to share concerns with the customer – such as when a broker knows a car is going to be delivered late.

And on the matter of forbearance, Asif said: “Brokers can support vulnerable or potentially vulnerable customers and assist funders in assisting a customer in difficulties.” However Asif warned brokers should consider their permissions if they started to stray into debt counselling.

Opportunity to reshape the Consumer Credit laws

Finally, Adrian Dally from the FLA reiterated the FCA’s position on motor finance. He said:

“Whatever finance you are selling it comes down to this: are you selling the right product to the customer? And are you providing the right information so the customer can make the right choice? Affordability and vulnerability should both be recognised.”

Dally added that the EU exit offered a real opportunity to reconsider consumer credit laws. “The current legal and regulatory regime for consumer credit is complex, out-of-date, inflexible and hard to navigate,” he said.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.