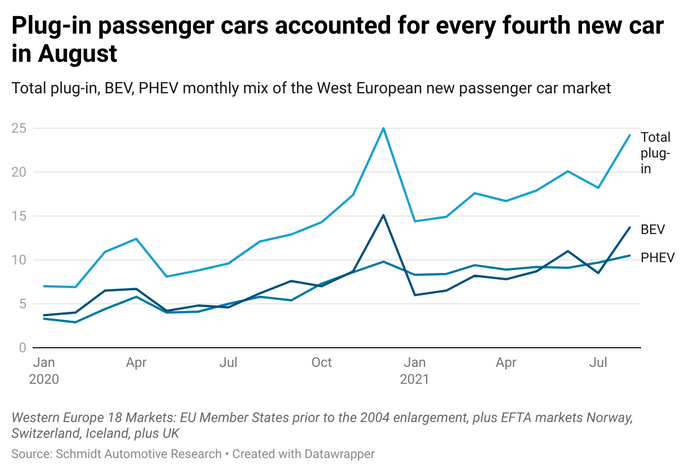

WESTERN Europe delivered a plug-in car every four vehicles during August.

This is the latest data from the European Electric Car Report, which found that pure battery electric and plug-in hybrid volumes reached 152,000 units in August, equivalent to 24.2% of the total new passenger car market.

It was only the second occasion this year that battery electric vehicles (BEV) outnumbered plug-in hybrids (PHEVs), says the report’s author, Matthias Schmidt.

This was was partially the result of an early shipment of Chinese-made Tesla models to Europe that arrived on European streets in August, Schmidt added, giving Tesla a 13% share of August’s BEV market, but also helping Tesla boost its share of the total West European market to over 1% on a rolling 12 month period.

More than 3,000 Tesla Model Ys

August also marked the European debut of the Tesla Model Y, with more than 3,300 models entering European roads, said the report.

OEMs balance profitable ICE models against EV demand

The report suggests that, with manufacturers struggling with the continued supply constriction on semiconductors, OEMs were prioritising their most profitable ICE (internal combustion engine) models over lower margin, higher volume models. But in a fine balancing act to meet EU CO2 fleet targets, these were counter-balanced by increased plug-in volumes.

Schmidt points out that data from Volkswagen showed the daily production rate at its dedicated all-electric MEB plant in Zwickau, Germany, showed no disruption from the semiconductor situation with production rising to the planned 1,500 daily rate, which would bring it close to its 330,000 annual capacity limit.

While the high year-on-year growth rates witnessed during the opening half of the year are expected to stabilise during the second half of the year, due to the COVID-impacted anomaly last year, manufacturers are likely to focus on more profitable and lower volume ICE models as long as the semiconductor issue continues to depress the total market. Consequently a more concentrated mix of higher profit and higher CO2 emitting ICE models can be expected in the second half of the year, forcing manufacturers to counter this with lower emitting plug-in models in order to reach EU CO2 fleet targets this year.

Matthias Schmidt, author, European Electric Car Report

BEV volumes to overtake PHEVs by year end

Despite opening eight-month PHEV volumes remaining ahead of BEVs – 680,000 playing 644,000 – pure electric BEVs are expected to finish the year ahead of plug-in hybrids, the report continues. It expects Chinese made Tesla models, and a possible Tesla Germany production start, to boost BEV volumes in the remaining four months of the year.

As a result, the European Electric Car Report said it had updated its forecast mix for pure-electric in the total market upwards, from 8.7% to 9.5%, for 2021.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.