THERE are an astonishing number of SMEs operating in the UK. At the last count – the beginning of 2019 is the most current information we have – there were 5.9 million Small and Medium-sized Enterprises (SMEs) operating in the UK.

According to the government’s statistics, most are micro businesses – those companies with fewer than nine employees – but an important and a critical target market for leasing brokers.

In particular the directors, who, unlike larger corporates, can act swiftly to take advantage of an outstanding lease deal and act very much like consumers – but essentially it’s a business-based decision.

Of course, respected opinion has been that such LTD owner/drivers and directors of smaller firms should privately lease their vehicles and take advantage of tax-free AMAPs at 45p per mile, rather than pay the onerous rates of company car tax on high-end SUVs and executive-style cars.

And while that has been the most tax-efficient method for some years, the introduction of 0% company car tax for electric vehicles (EVs) for the 2020/21 tax year, and the greater availability of vehicles (Tesla Model 3/Audi e-tron/Porsche Taycan and so on), has swung the balance back to taking a car on the company to take advantage of those rock-bottom company car tax rates (plus the business advantages of leasing, such as VAT reclamation).

So now is the time to talk to company owners about swapping into the company car

But how do you demonstrate the advantages of a company car to a small business director, or the owner/driver of a micro LTD, having told them for some time that it’s not been the correct answer?

Using the BCF Wessex developed Gensen software, we can construct a variety of examples that demonstrate – depending on vehicle choice – the most tax-efficient methods open to company directors.

Audi Q7 SUV: personal lease or company car?

Let’s take the Audi Q7 SUV as our example and plug in some numbers to the Gensen calculator. Based on a 3+33/30,000 mile contract for an additional rate taxpayer, assuming insurance is £1,000 per annum and there are 2,000 business miles a year. With petrol at £1.14 per litre and electricity at 4ppm, let’s see what answers we get.

Looking at the petrol Q7 first, the big Audi is staggeringly expensive as a company car, because it’s very heavily taxed. So the owner of the business is not only paying a hefty amount for the car lease in the business, but a stack of company car tax and Class 1A NIC too. So in this instance, and despite the VAT inefficiencies of a personal lease, it’s significantly cheaper to procure the big SUV this way because those tax and Class 1A NIC charges are avoided.

Having established that scenario, we can then look at the PHEV version of the Q7 as a suitable alternative, if your client wanted to run it on the business. In which case, compared with its petrol equivalent this is the vehicle to choose – it’s more tax efficient and would actually cost marginally more on a personal lease anyway, thanks to that higher list price.

But is that the optimum for your client and their business?

While it might be tempting to cut and run with the deal, are you really treating the customer fairly – especially as the client is balanced between regulated and non-regulated business? Have you considered all the deals for the client?

There’s another option which we can consider. And that’s the electric Audi SUV: the e-tron. With the highest list price by some margin, and the most expensive monthly rental, by all the usual headline rental reckonings, the e-tron should be out of the picture. But you need to keep your client engaged, because over the course of the three years, the lower operating costs and superior tax advantages of the electric Audi make it the most cost-effective and tax-efficient car for the director to take on a business contract hire. Job done! The e-tron is the choice for your client.

What about executive level cars – how do these work for company directors?

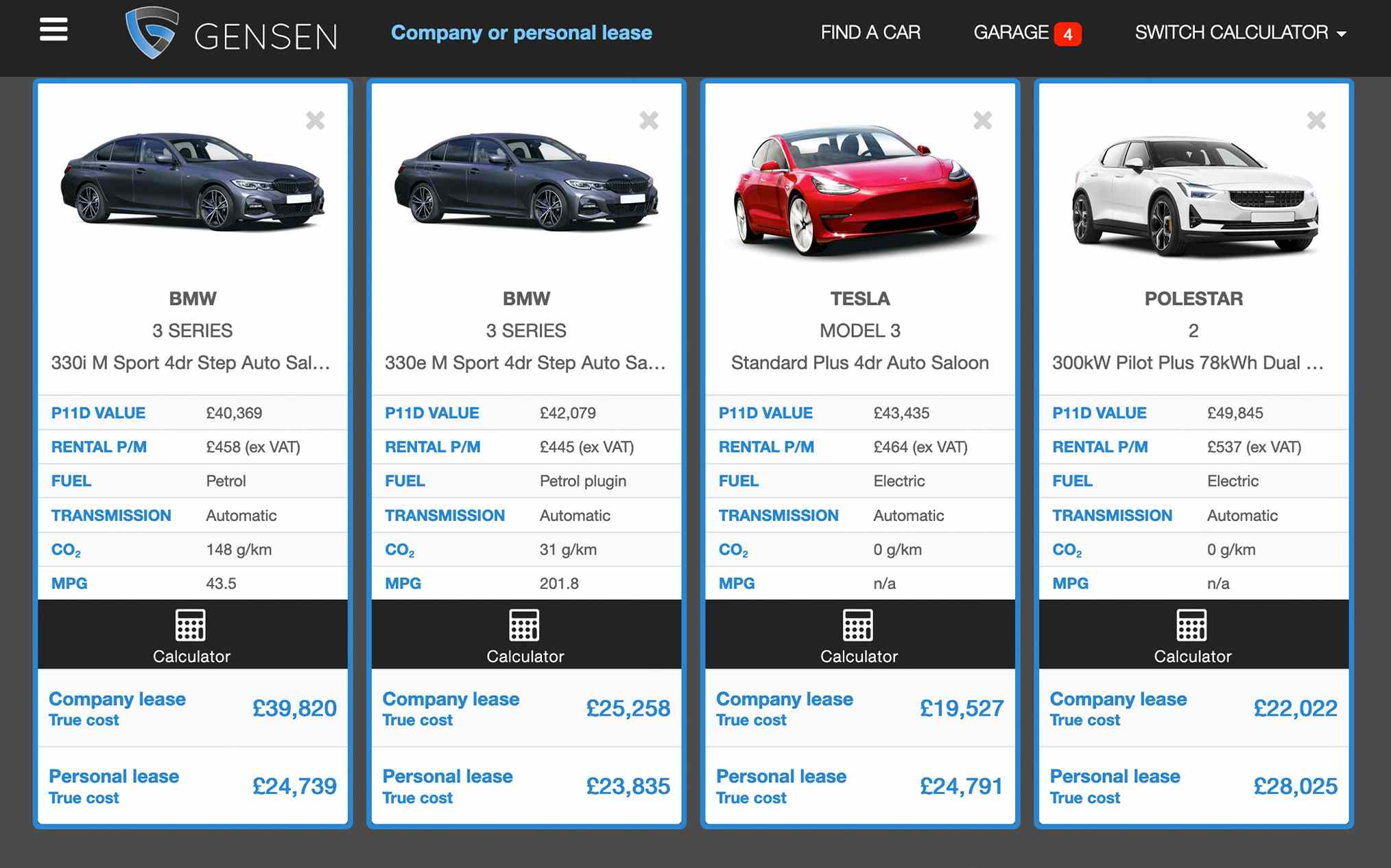

Let’s consider the executive level BMW 3 Series, and see how this works out for a business owner/driver.

The parameters we plugged into Gensen are the same as for the Audi SUV, except the driver is now a higher rate taxpayer.

In the first example, we have the 330i M Sport being leased personally by the company director, which is absolutely the right decision given the cost to the company of £39,820 versus £24,739 on a PCH. Personal leasing avoids the hefty benefit in kind taxation and Class 1A NIC charges for the company car.

But seeing as we’re talking BMW, there is another option, and that’s the PHEV version of the 3 Series with CO2 emissions of just 31g/km. The petrol plug-in hybrid is far better on a company lease than the petrol M Sport version by nearly £15,000, but it’s also marginally cheaper on a personal lease basis. So what should you advise your client?

There remains the option to go electric with either the Tesla Model 3 or the Polestar 2. Once more you will have to guide your client past the more expensive P11D values and the towering monthly rentals and get them to concentrate on the bottom line costs. Because here is where the value to them lies as company cars.

Taking these vehicles on the business is more tax-efficient than personally leasing them (more expensive than both the BMWs, by the way) with the Tesla Model 3 Long Range offering the company director a round figure saving of £3,500 when compared with taking the 330i on a personal lease.

Once more, it’s a question of demonstrating the whole life cost values of electric vehicles, rather than just being blindsided by monthly rental costs.

And with some 5.3million SMEs to target, that’s a lot of potential business waiting to be unlocked – as long as you know your figures and can demonstrate them to your clients.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.