THE changes made by HMRC to company car benefit in kind (BIK) tax from April this year effectively ruled out most ICE (Internal Combustion Engine) cars for business cars.

Not all, that’s true. But most have become increasingly uncompetitive on BIK tax.

The focus on clean air, particularly in urban areas, and the government’s urgency to bring forward the banning of all ICE cars to 2035 or earlier (subject to consultation) is the significant driver behind this change in taxation.

But it’s not only on tax where ICE cars have become uncompetitive. They are increasingly out of kilter on whole life cost (WLC) calculations over the period of the lease, too.

However, this is not always obvious when the headline monthly rentals look so prohibitive. So it’s important for brokers who are consulting with fleet and business customers to communicate an effective counter argument based on WLC.

BMW diesel versus EV company car choice

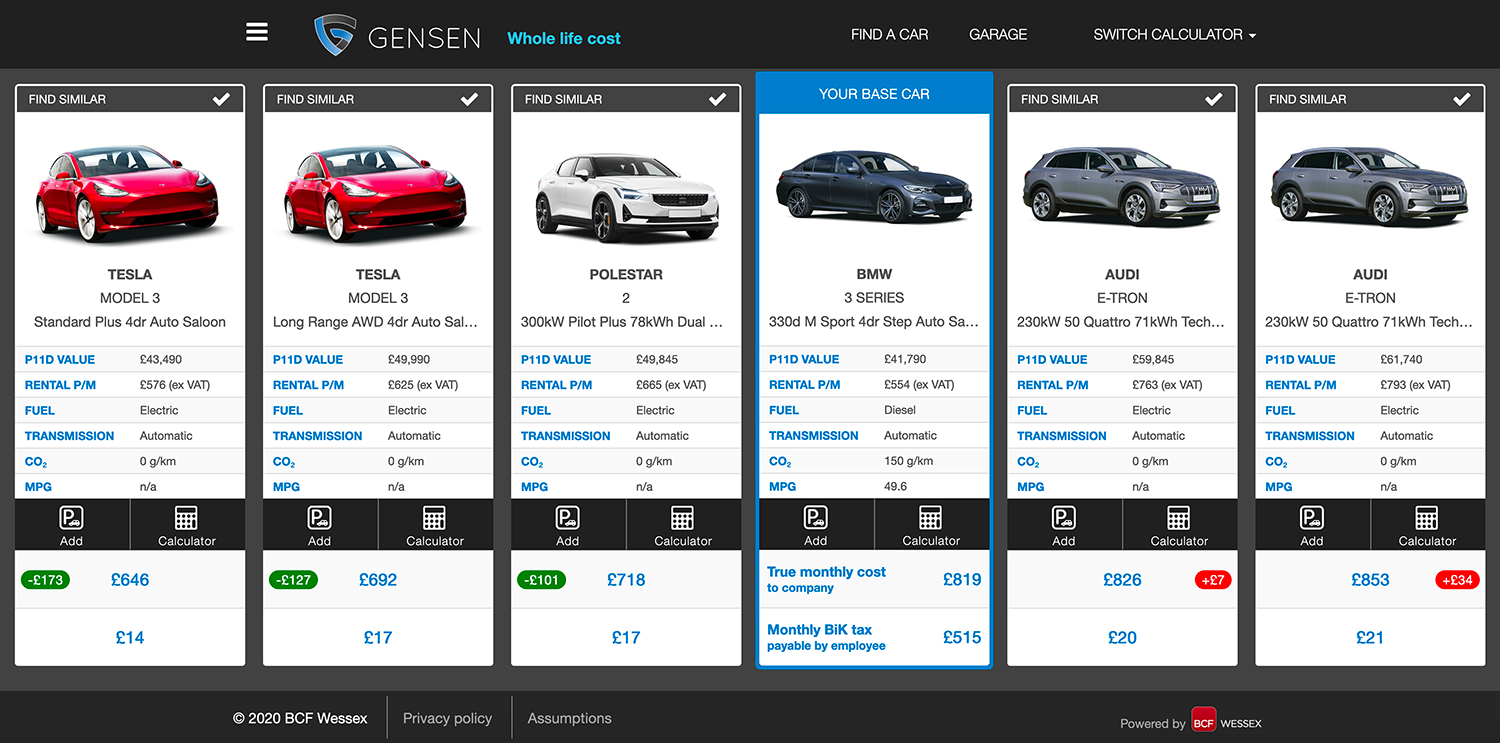

Using the Gensen WLC calculator, developed by BCF Wessex, you can effectively drill into the costs associated with ICE and EV cars to establish how the headline rental differs from the WLC over the term of the lease.

As an example, let’s take a typical executive car – the BMW 330d in M Sport trim – driven by a 40% taxpayer. This highly desirable vehicle has CO2 emissions of 150g/km and still attracts the 4% diesel surcharge as its engine is non-RDE2 compliant.

With a P11d value of £41,790 and a monthly rental of £554, what are the electric options? Well, the driver could look at a Tesla Model 3, which may be on the policy list as it’s close on P11d, at £43,490, and monthly rentals are close-ish at £576.

However, this is the Standard model, and the driver may possibly want the added reassurance of the Long Range edition to allay range anxiety fears, but the monthly rental for that exceeds £600 so it is outside the fleet’s choice list. The same is true for the highly desirable new Polestar.

But if you dig deeper into the WLC, not only is the Long Range Model 3 attainable it would save the business cash: it’s actually £127 per month cheaper. So the advice to the business should be that the driver is allowed to select this car (as they should the Polestar), since only referencing headline rentals leads to incorrect decision making. Furthermore, the driver could make some massive BIK tax savings as well.

And it’s crucial to consider these tax savings in any holistic view of a fleet or business decision. Since the BIK tax is so low, the driver could ask to upgrade his choice to an Audi e-tron and pay the difference between the BMW and Audi by means of a salary sacrifice from the driver’s tax saving. See the illustration in the table below:

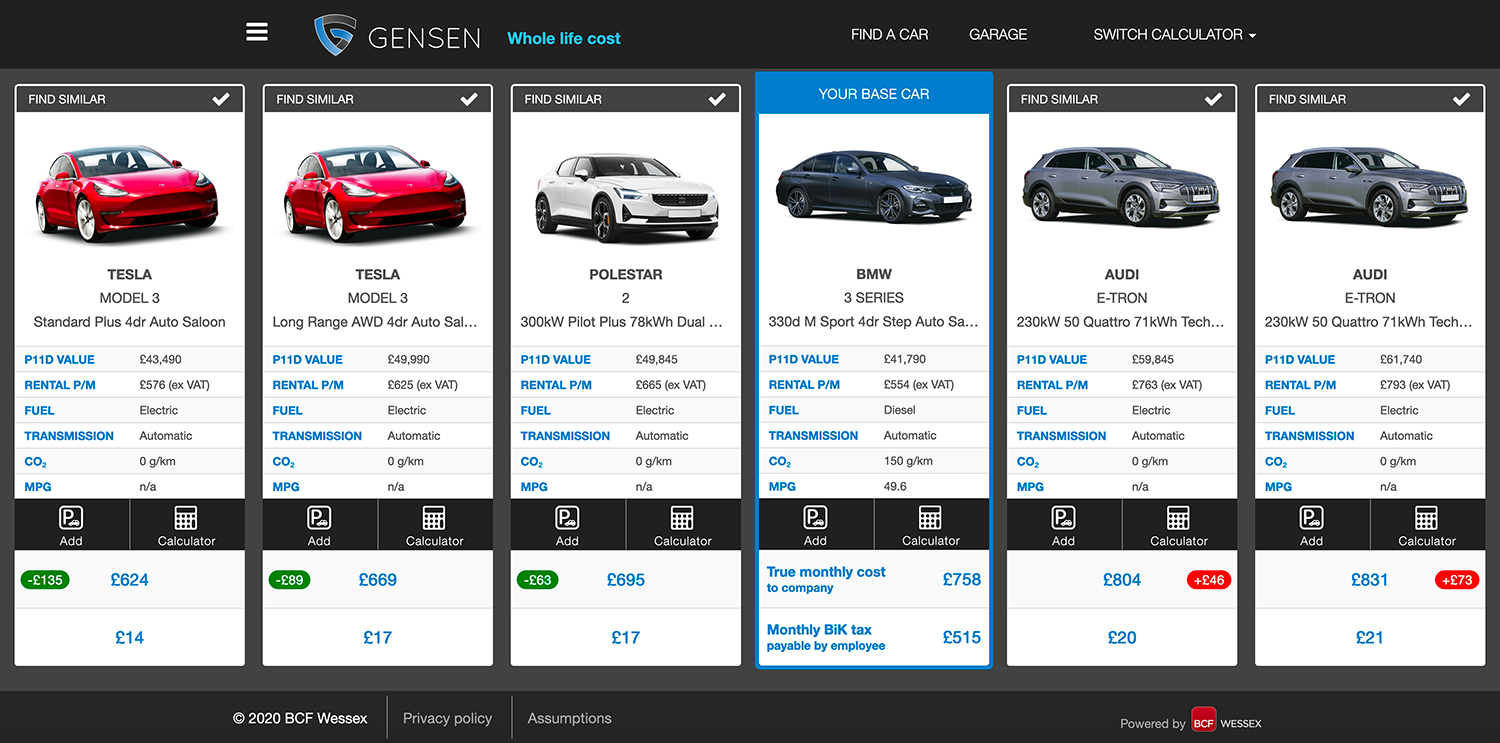

Does this comparison still work if it’s a perk car?

Our previous illustration was built around 10,000 business miles a year. But if it’s a perk car with no business miles, can the electric car still beat the BMW? Using the easy to use filters, you can reset the calculator to zero business miles, and as we can see in the illustration below, the ICE BMW still loses out against its EV competitors. And since it’s a perk user, it’s more relevant to choose the Standard Tesla Model 3 in which case both business and driver make substantial savings – see illustration below:

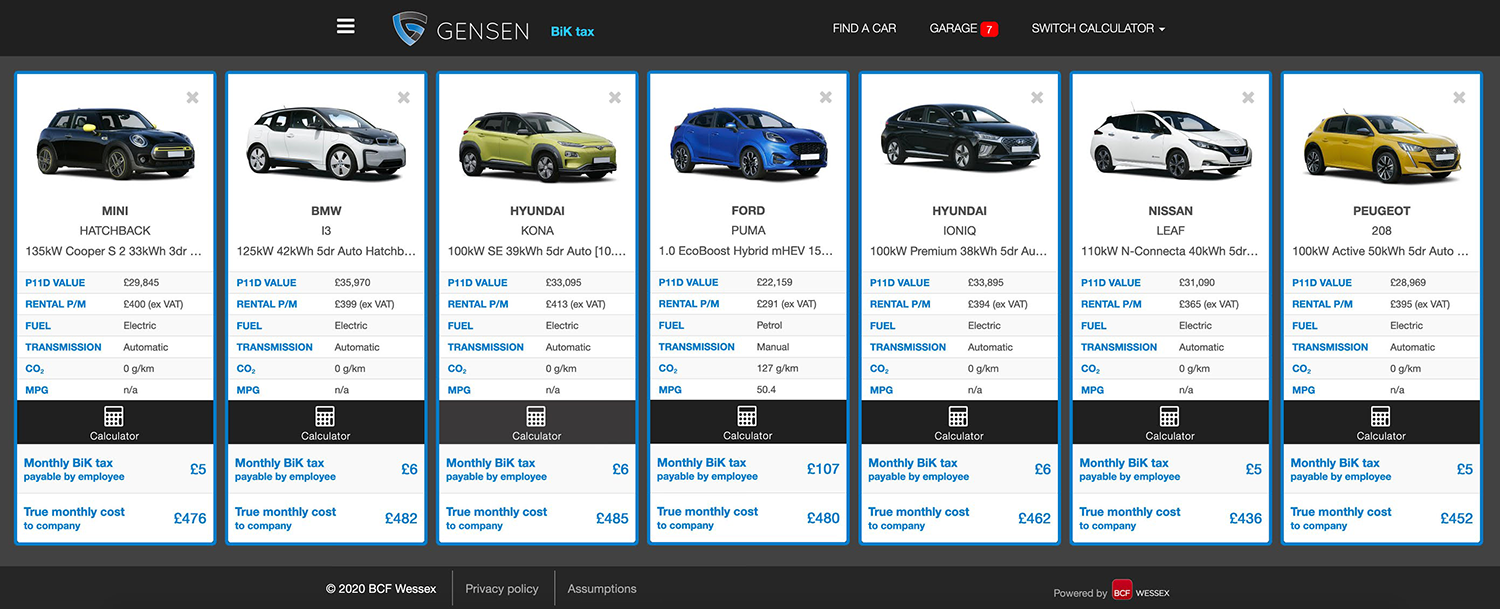

EVs cans still work for essential users – ICE Puma versus EV

While it might be assumed that the tax advantages for a higher rate payer play into the hands of a switch to electric cars, closer analysis of the WLC of petrol vehicles also reveals why a switch to an electric car is not only the cleaner option, but the most financially viable, too.

In this instance we have taken Ford’s Puma crossover SUV model, currently receiving a fair amount of advertising exposure on television.

Rental and list price of the Puma are £291 per month and £22,159 respectively, but with emissions of 127g/km the average BIK tax for a 20% taxpayer is £107 per month.

All round this appears a fairly appealing arrangement. After all, it would be difficult to find a better fully maintained alternative via a PCH agreement.

Furthermore, the company you are consulting with says that the electric alternatives you have proposed are not only too expensive on the monthly rental, but way out on the P11d, too.

So what’s the answer?

Again, the Gensen WLC calculator can drill down into the actual costs to provide a clearer picture of the WLC impact on vehicle choice.

What’s included in the WLC?

Business costs

- Rental

- Maintenance

- Business fuel

- Insurance

- Class 1A NIC

Minus allowances

- VAT recovery – rental, maintenance, business fuel

- Tax relief – rental, maintenance, insurance, Class 1A NIC

And what that shows is that there are plenty of electric alternatives that look expensive on monthly rental but work on WLC and deliver welcome tax savings for the driver. Using salary sacrifice, the driver could even upgrade should the business wish to offer this. Some of the alternative choices are illustrated below, although the Vauxhall e-Corsa and Renault Zoe would also make suitable alternatives.

Conclusion ICE v EV

Brokers who are consulting on fleet policy clearly have a great opportunity to convert micro businesses and SMEs and their fleets back into the company car through the advantages EVs offer in their cost of operation and the driver taxation advantages.

But clearly communicating a complex message is a different matter, especially when the client can only see the headline rental.

Tools such as Gensen offer a clear way of demonstrating the compelling financial reasons to consider EVs; the next step is to communicate that to the company’s employees to start a successful transition from ICE to electric driving.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.