Image capture tool offers damage price transparency at end of lease

22% end of lease damage is to wheels

- 13.5% end of lease damage is to bumpers

- Wondle says it puts the customer in control, reduces end of lease friction

- Launched by two ex-LeasePlan executives

- Integrated into Automotus websites

A SIMPLE to use image capture assessment tool that estimates end of lease damage is being released to brokers by Wondle.

The new product comes from two former LeasePlan executives Simon Carr and Matt Cranny. It allows a customer to log onto the Wondle website before being directed around the lease vehicle capturing a series of images. With the images uploaded, the damage is assessed in three minutes against a matrix of seven leaseco repair cost baskets.

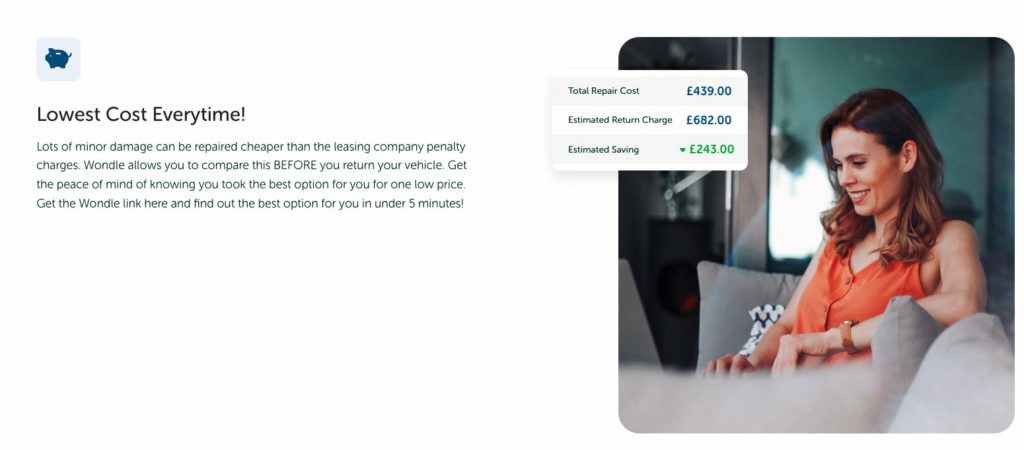

The company says it allows the customer to look at the expected cost they might face for end of lease damage, or whether it’s more cost effective to return the car without repair.

The point of Wondle is to put the customer in control. End of lease damage is the Achilles heel of leasing. Customers find it difficult to understand what is end of lease damage and what is acceptable. The Wondle system gives the consumer information on which they can then make informed decisions.

Once we have correctly identified and classified the type of damage, its severity and its location on the vehicle, we use a bespoke matrix, which is a blend of the lease companies' publicly available pricing matrices most of the top seven publish, as well as some of the smaller ones. This provides a definitive range and an indicative midpoint to give consumers and fleets more information to get the best outcome for their situation.

Simon Carr, director, Wondle

Wondle says its research suggests it’s a significant problem with 80% of consumers trying to do something with their car before it goes back to the leasing company, but 50% still get a recharge. “As a consumer it’s a complex process and the number one reason for escalation to mediation services,” adds Carr.

The company says AI was used to construct the platform and they then built an algorithm on top of that to cost the range of pricing for damage. The advantage for brokers, the company points out, is that they can intervene in the value chain and prevent customer unhappiness post vehicle return.

Consumer Duty is all about good outcomes for customers. Wondle can help brokers put together Consumer Duty plans for risk averse customers by showing they can follow up on the customer and help them identify the risk. There's also the revenue opportunity to offer heavy car users a smart repair programme as a natural part of the sales process.

Simon Carr

Wondle integrated into Automotus website platform

Leasing brokers using Automotus websites will find that Wondle is built into the website back-end CRM offering an automated process towards the end of a customer’s contract.

Non Automotus customers can build Wondle into the customer journey, added Frankie Healy of Automotus.

It’s a real win for brokers and leasing companies. The general public has no idea how much damage costs to rectify. With Wondle integrated automatically into the customer journey, there’s less chance of dispute escalation because the customer has been given an accurate indication of the likely cost. It puts recharge into a whole different context.

Frankie Healy, director, Automotus

Automotus created the website and embedded the damage algorithm models to the platform that sits on top of the image capture tools.

Automotus is a Broker News partner.

Express Vehicle Contracts named Best Independent Vehicle Leasing Company 2024 in SME UK Transport Awards

Express Vehicle Contracts named Best Independent Vehicle Leasing Company in the

SME UK Transport Awards 2024.

Optimism over Discretionary Commission Arrangements says Jonathan Kirk KC

There are three key reasons for optimism over the issue of discretionary commission arrangements (DCAs), delegates to a VRA meeting were told

Stellantis adds Chinese low-cost Leapmotor to UK brands

Stellantis will add low cost Chinese electric car maker Leapmotor to its UK brand line up in March 2025 as part of its joint venture

Fifty2One broker website business up for sale

Clitheroe based software specialist Fifty2One is offering up its leasing broker website concern for sale. Are you interested in the business?

BMW shows scorching growth in company car market

BMW is racing ahead as the company car market dominates the automotive sector according to latest SMMT stats

The Leasing.com PCH temperature check: April 2024

Leasing.com and Broker News bring you regular insight on what is moving and shaking in the PCH market. This month: April 2024

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.