“The UK automotive sector is undeniably experiencing the expected shift toward a ‘push’ market.

“Increased tactical activity is evidenced by reported fleet numbers, reflecting a strategic effort by OEMs to address and resolve market share dynamics. This trend emphasises the current volume-centric nature of the sector, which bodes well for the overall economy.”

COX Automotive says that UK car market has swung into push mode following the latest registration figures.

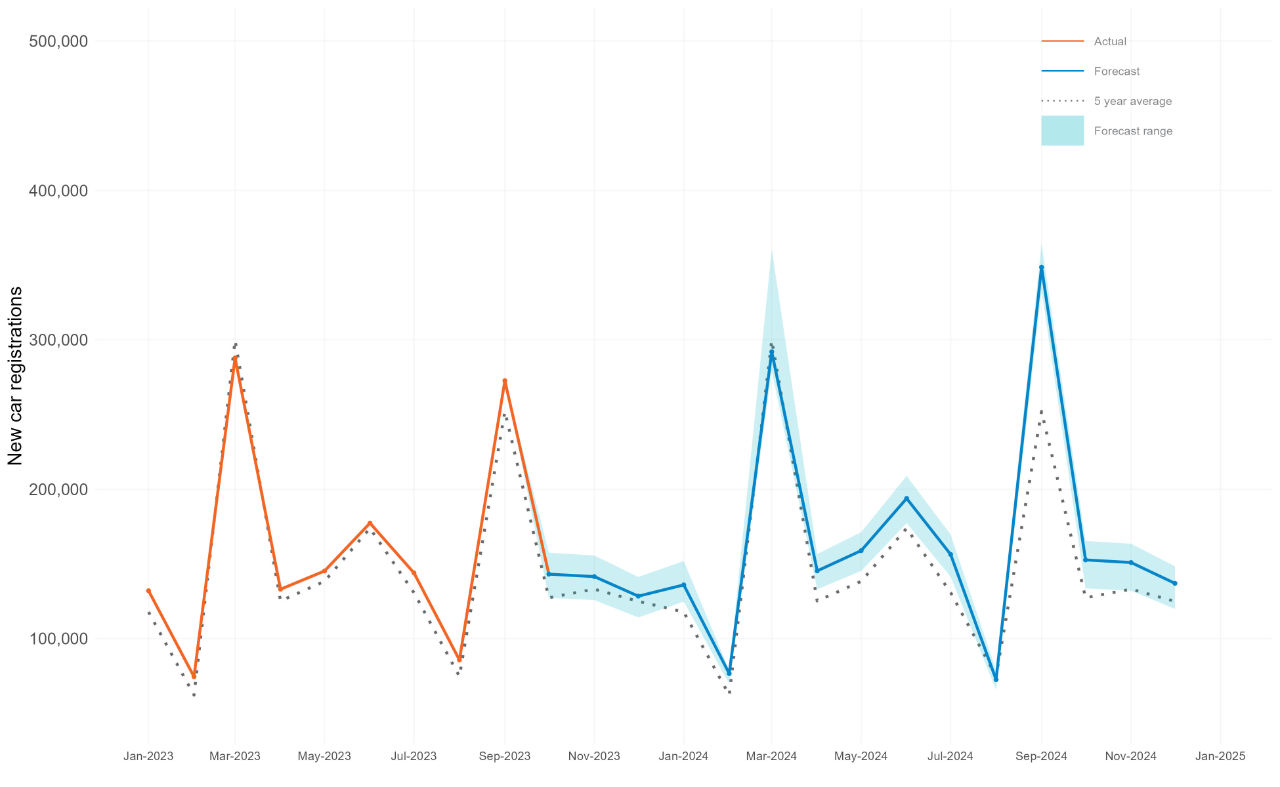

The company says its forecasts for 2023, published every quarter, predicted that new car registrations would total 1.94 million by year’s end. With its year-to-date baseline forecast of 1,651,611 proving 97.2% accurate to the SMMT’s recently published actual figure of 1,605,437, Cox Automotive says its confident that its full-year forecast remains a reliable guide.

Cox Automotive’s insight director Philip Nothard (main picture) said:

“As we head into the homestretch of 2023, we stand by the accuracy of our market-leading forecasts which have proven, time and time again, to be copper-bottomed.

“The most recent SMMT figures give us even more confidence in their accuracy and, what’s more, chime with the widespread belief that the new car arena has returned to a ‘push’ marketplace.

“Our analysis tells us that tactical registrations, a relic of the industry’s past, are taking place on the part of OEMs. That could help explain the increased percentage of reported fleet registrations, in addition to OEMs returning to the recently constrained fleet channel. It is clear they are moving to resolve their market share.”

October’s registration figures from the SMMT recorded the best new car registrations since 2019 although EV growth remained subdued. October saw 153,529 new cars take to UK roads – a 14.3% year-on-year increase. The SMMT believed that growth was largely due to the purchasing activity of large fleets, which accounted for three in four EV sales over the past year.

“Both the new and used markets continue to face challenges, such as the cost-of-living crisis hindering demand,” Philip said. “In 2024, the sector will witness a surge in OEMs transitioning to new agency or hybrid dealer networks across the UK and Europe. This shift may present volume and market share fluctuations, as adapting to new systems, processes and strategies takes time.

“The new car numbers and our outlook for the coming years reaffirm that this industry is characterised by volume and is positive for the economy, as it will generate more jobs and income.

“We foresee continued growth for 2024 albeit at a slower pace than in 2023. And we also believe the muted private demand for new EVs has to be tackled by more government incentives. It remains to be seen whether the 2035 ICE deadline will continue to impact the sale of new EVs.”

What is Cox Automotive's forecast for 2024?

Cox Automotive is predicting a baseline figure for 2024 of 2,020,050 cars. This is split over the four quarters like this:

Q1 504,396

Q2 497,892

Q3 577,321

Q4 440,440

If the market does well, Cox Automotive suggests a possible new car market of 2.2m; if the market does badly, then Cox Automotive predicts a new car market of 1.85m.

The report suggests that the market will face a variety of challenges, not least from the transition by some OEMs to the agency model, new UK and EU legislation, the growth of electrification and economic headwinds.

Cox Automotive’s new car forecasts consider economic, local and legislative factors, such as the ZEV mandate which will influence where and when both ICE vehicles and EVs will be registered.

Its forecasts for 2024 and beyond are also published as a part of its fifth annual Insight Report, which includes a deep dive into key issues currently facing dealers, OEMs and fleets.

Select Fleet Solutions – Eton celebrates 25 years

Select Fleet Solutions – Eton Office, formerly Benchmark Leasing, is celebrating 25 years in the leasing broker sector

Wessex Fleet chooses MotorComplete broker platform for ARs

Wessex Fleet has selected the MotorComplete broker platform to provide websites for the Wessex Appointed Representatives (ARs)

New executive appointments in the fleet and leasing broker sector

There have been a raft of new appointments in the fleet and leasing broker sector, including the appointment of Ian Jeffery at PHVC

Broker News Awards 2024 in pictures

The Broker News Awards 2024 took place at the Orrery in London’s Marylebone. Here are the pictures to remember the event

Broker of the Year 2024 winner profile: Synergy Car Leasing

Synergy Car Leasing was voted Broker of the Year 2024 by the judging panel – here’s the winner’s profile supported by Leasing.com

Broker News Awards 2024 – the winners

The Broker News Awards 2024 – supported by Fleet Procure – produced outstanding winners, with Synergy taking the Broker of the Year title

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.