SALARY sacrifice is booming. July’s BVRLA Leasing Outlook reports that the product grew an astonishing 41.2% to reach a total of 35,134 cars.

However, not all leasing brokers are offering customers the option of a salary sacrifice product. But there’s an opportunity for all brokers to capitalise on this growing sector of the market and open up further sales channels.

BCF Wessex, makers of the Gensen quotation tool, explain how it can be done.

Getting the right quotation platform

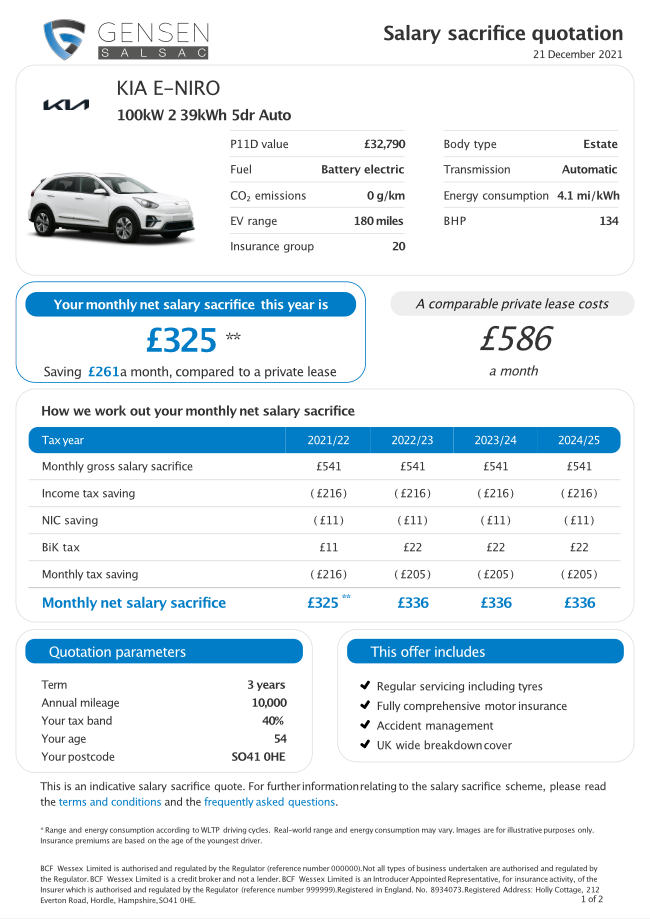

The employee benefits on salary sacrifice are generated by the reduction in gross salary, producing income tax, National Insurance (NIC) and Health and Social Care Levy (HSCL) savings. And, depending on the employer’s VAT status, there my be additional VAT savings for employees as well.

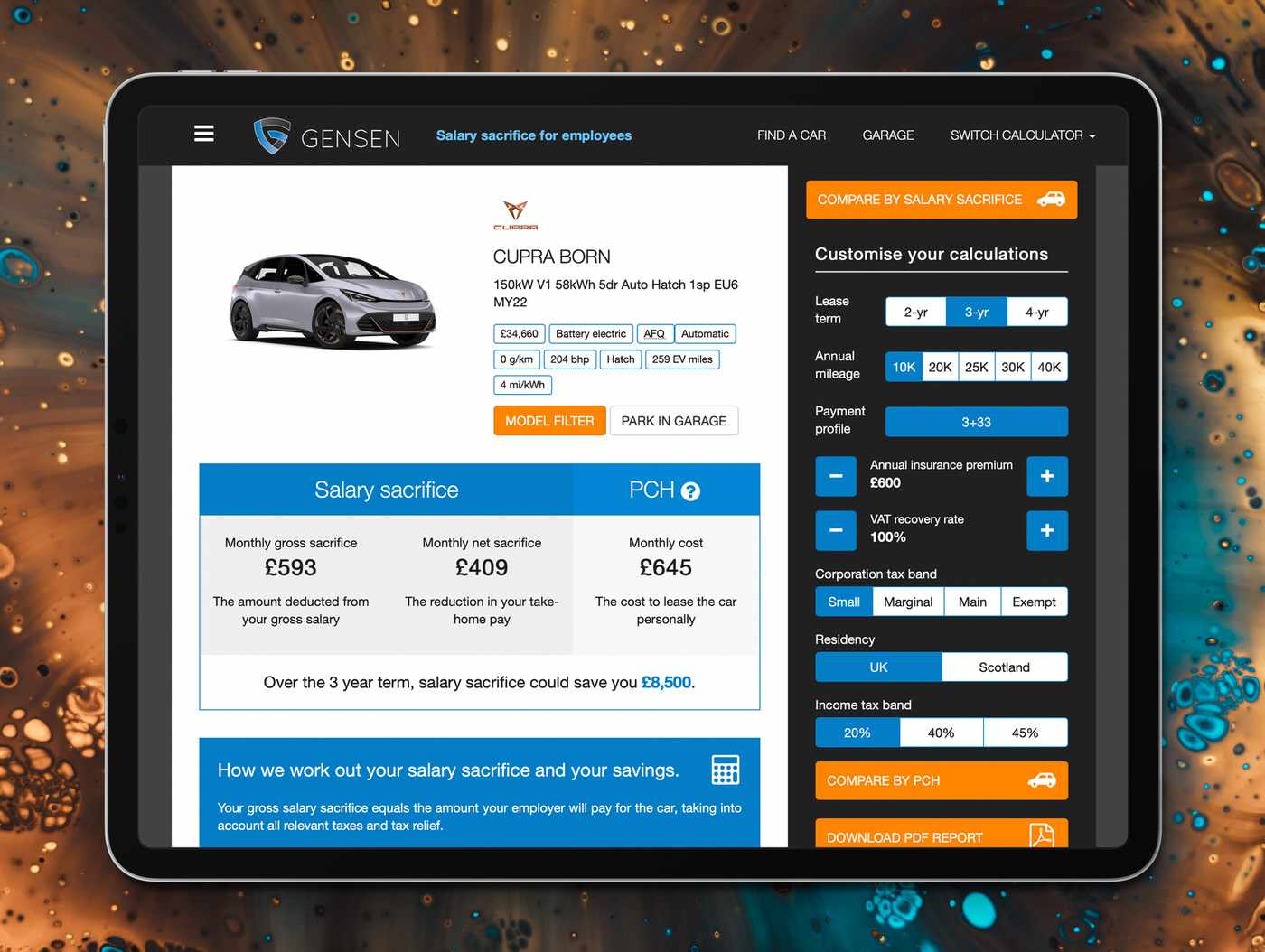

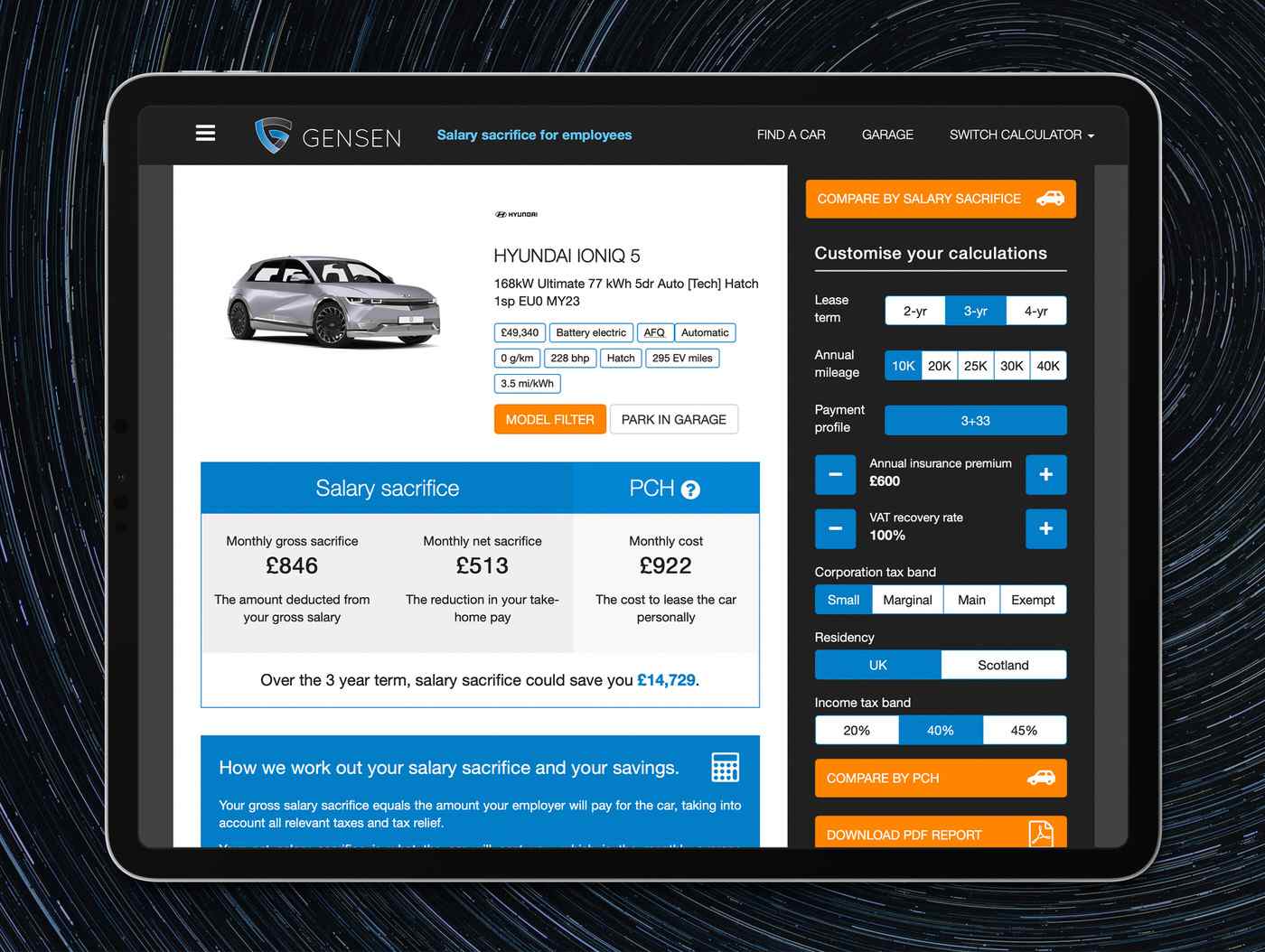

In this quotation below, for the Hyundai IONIQ 5, you can see the savings an employee can expect on a gross salary sacrifice of £846.

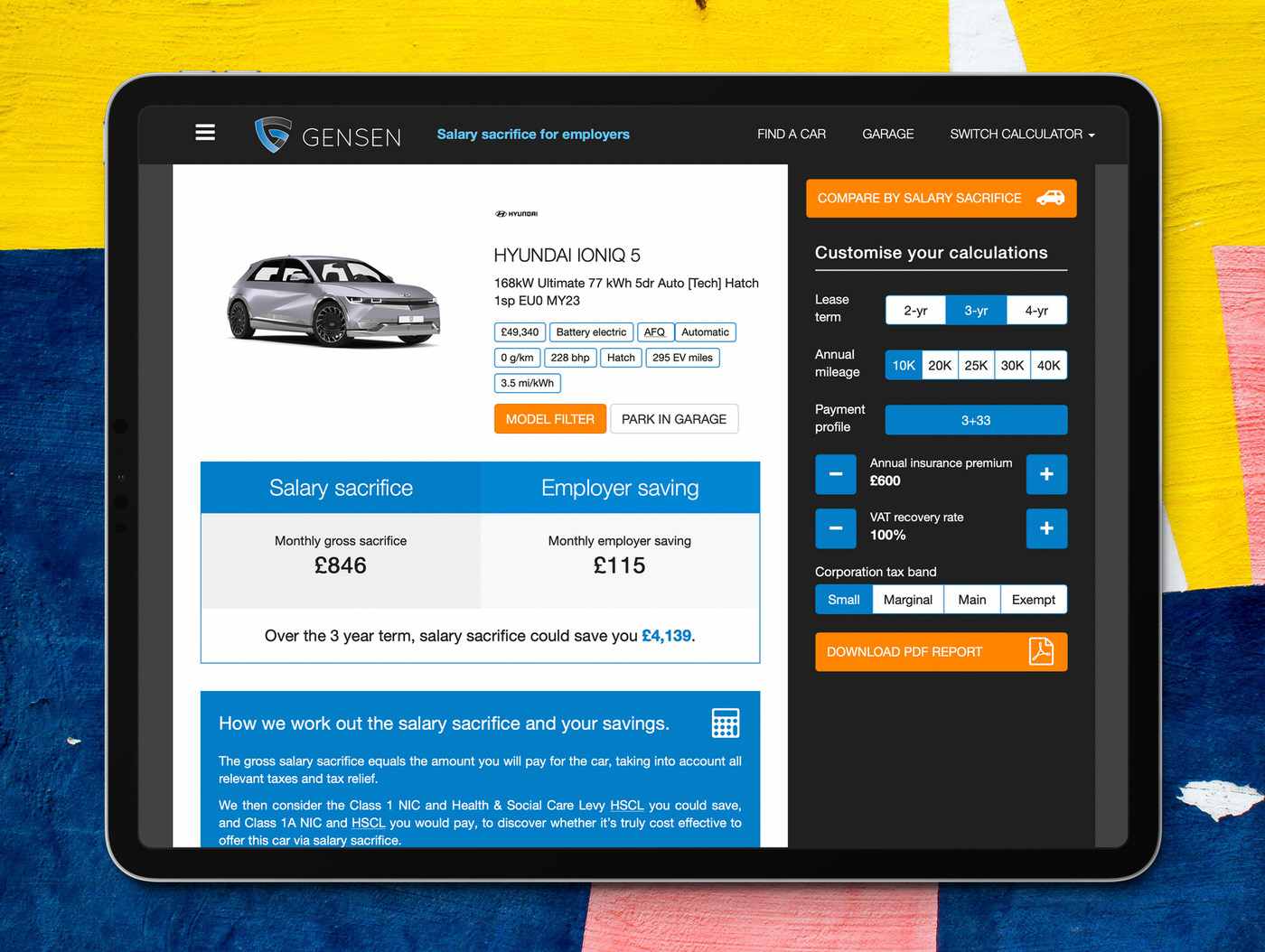

The employer can also enjoy a lower cost base, too, by offering salary sacrifice to staff. In this example, the IONIQ 5 again, there is a £115 monthly saving.

But offering the capability to translate a Business Contract Hire (BCH) quotation into a salary sacrifice quotation requires a proper quotation tool.

Gensen is offering two methods:

- Online platform – see the Kia e-Niro quotation below – this solution is best suited to those brokers who expect to scale their salary sacrifice offering.

- Smart spreadsheet – this solution is designed to help any broker enter the market and potentially build a scalable offering.

Based on the Gensen suite of whole life cost calculators, the online quotation platform offers a simple approach to demonstrate the savings to employees and employers.

Scheme documents

Like any financial product, your customers will have a range of questions. So to support your salary sacrifice quotations you will need promotional material to demonstrate the benefits of salsac, such as factsheets and example quotations.

Also useful will be FAQ style material to answer a range of questions that both employer and employee might want to sask, along with operational material such as payroll guides to ensure correct implementation of the product by the implementing company’s finance department.

Demonstrating technical knowledge

As a provider of salary sacrifice, a leasing broker will be expected to answer a range of questions. The key ones are:

Eligibility – which employees should take part?

- Should temporary or fixed term employees have access to the scheme with the resultant increased risk of early termination?

- Do lower paid employees qualify? And what about the impact on the National Minimum Wage? And how do you treat part time staff?

Paying early termination charges – there are a range of solutions available. The ones to consider are:

- Early termination protection – here, the leasing company takes the risk and does not charge an ETC in exchange for an increased monthly rental. To ensure the employer is not disadvantaged, the NIC savings in most cases are used to subsidise the ETC.

- Early termination insurance – in this case, the employer takes the risk, but insures all or some of the cost. Again, the NIC savings can be used to mitigate any ETI.

- Self-funding from NIC savings – again the employer takes the risk and meets the cost from the NIC savings. This third option is the most commercially and financially viable and allows the employer to retain control.

Payroll – many employers will ask about payroll but with a payroll guide it’s not as difficult as envisaged, especially for those employers who currently offer company cars and/or salary sacrifice for other benefits, such as cycle to work schemes or childcare vouchers.

Credit – What’s the impact on existing credit lines if an employer’s fleet grows?

Accounting – how will salary sacrifice for cars affect the customer’s balance sheet?

To ensure a confident presentation you will need to be able to demonstrate your expertise in these areas.

A six stage implementation plan

This is a simple six step programme for leasing brokers to to benefit from the growth in salary sacrifice.

- Market – identify your target customers (at employer level) and sell the benefits

- Qualify – engage with the prospective customer to understand how many employees might be interested, what savings can be generated and what issues are likely to be encountered

- Set policy – establish the ground rules and implement a salary sacrifice policy with your customer

- Promote – working with your customer, sell the benefits to the customer’s employees and ensure there’s a long-term plan in place – not everyone wants a new car on launch day

- Implement – set up your quotation platform and get your scheme documents in place

- Operate – run promotional events, prepare quotes, order and deliver cars, support payroll operation

Conclusion

Every leasing broker with corporate clients should be able to take advantage of salary sacrifice. But it’s not simply a question of running BCH quotes and letting your customer get on with it.

A successful salary sacrifice provider supports its customers every step of the way. And those leasing brokers that consider the issues and have a plan should be successful.

Next steps

BCF Wessex is highly experienced in salary sacrifice. The business is already helping more than a dozen clients with salary sacrifice programmes and can help your brokerage manage all aspects of salary sacrifice provision.

If you would like to know more, contact

BCF Wessex about salary sacrifice here:

https://www.bcfwessex.co.uk/contact

Automotive and fleet writer for Broker News