NOVEMBER new car registration data has seen Mercedes yoyo back into positive territory with a 48.1% increase during the month. While the jump has pushed the premium brand to a year-to-date increase of 5.1%, the overall market is up 18.6% in the first 11 months of 2023. As a result Mercedes’ market share has dropped from 5.2% this time last year to 4.6% now.

Official figures released by the SMMT have revealed that Mercedes pre-registered 170 cars in October. The next nearest pre-registration figure was Nissan with 20 cars.

Overall market slows down in November 2023

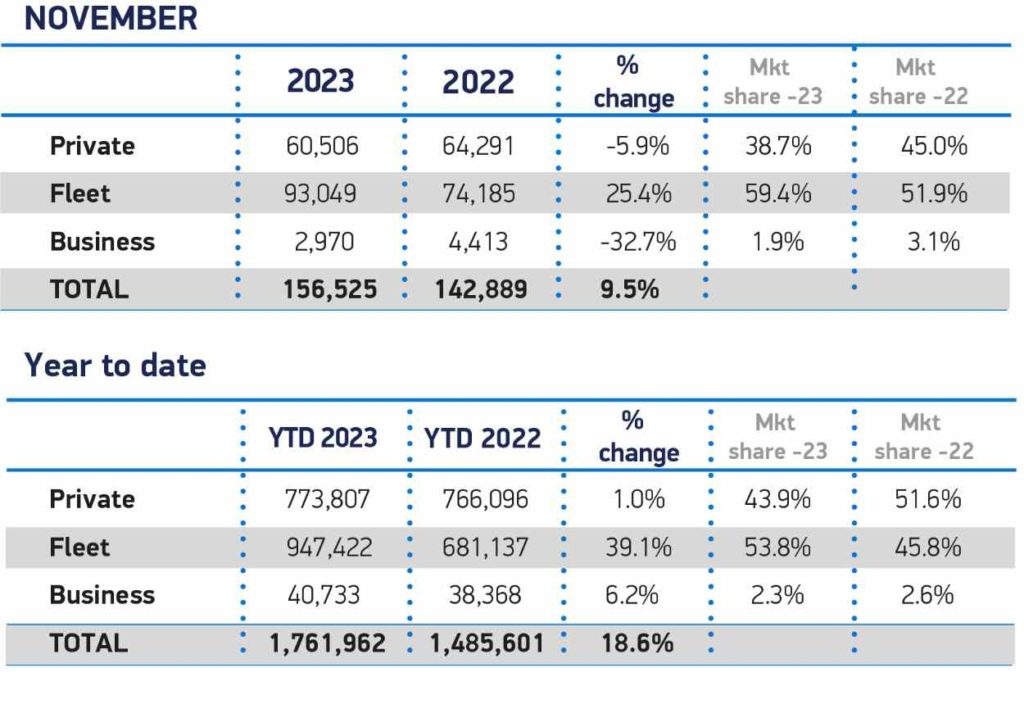

The rate of growth in the new car market slowed in November to 9.5% to reach a year-to-date total of 1.76 million units.

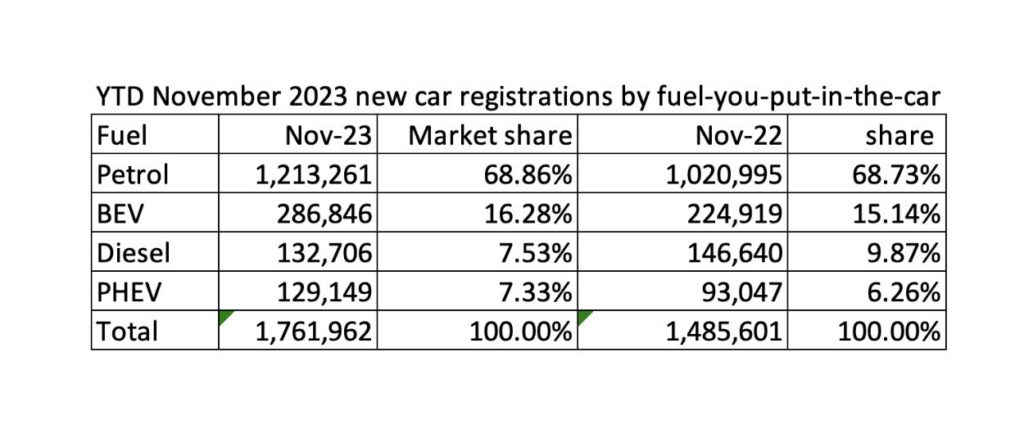

Sales of new electric cars are up more than 27% so far this year and account for 16.3% of the market. However, the latest official figures show the proportion of electric cars sold in November dropped to 15.6% of the market.

Industry commentators have blamed the government’s lack of incentives for private buyers for the smaller market share plus the shift in the ban on new ICE cars to 2035. However, the number of electric cars sold in the month was still up 22% on November 2022.

However, the market was partially distorted by Tesla which had a particularly low number of deliveries compared with November 2022.

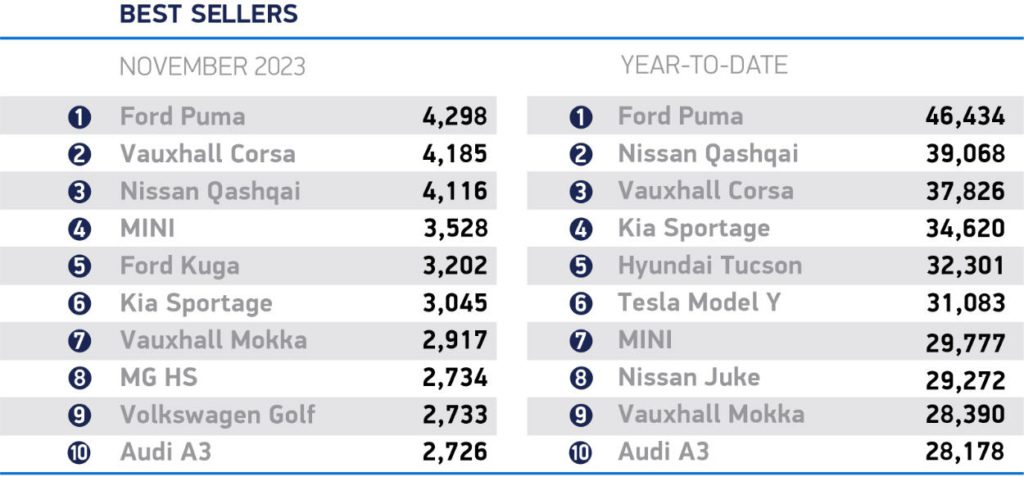

A year ago the all-electric brand sold 6,025 cars; this November it sold 1,648 cars. However, Tesla is still running up 15% for the first 11 months of 2023 and the Model Y is still the sixth best-selling car this year (see chart below).

Plug-in hybrids saw a huge jump in sales last month, up 78% on the same time last year and taking just over 10% of the market. Year-to-date, plug-in hybrids are up 39% and account for 7.3% of the new car market.

The 18.6% rise in overall registrations has been driven almost entirely by the company car market. Fleet registrations are up 39.1% so far this year with business registrations up 6.2%. Private sales are up just 1% year-to-date.

Car dealers that Broker News spoke to have reported that retail demand for electric cars has significantly slowed in recent months with stocks of unsold EVs increasing.

Car dealers that Broker News spoke to have reported that retail demand for electric cars has significantly slowed in recent months with stocks of unsold EVs increasing.

Commenting on the EV market in November, Nick Williams, the Lex Autolease managing director, (pictured), said:

“Last month, electric vehicle (EV) registrations for the year surpassed the total number of EVs registered in the whole of 2022, with registrations now at 286,846, against a total 267,203 vehicles registered last year.

“Long-term commitments from policymakers, such as the ZEV mandate and 2035 ban on petrol and diesel vehicle sales, are continuing to support electric vehicle adoption as both buyers and manufacturers have the confidence to invest.

“The recent commitment from Nissan is a case in point. For the UK to lead in vehicle electrification and deliver the electric transition, it is vital we continue to encourage OEMs that Britain is the most attractive place to build their electric vehicles.”

Market winners and market losers

Despite a 2.4% drop in sales in November, Volkswagen continues as the UK’s largest brand with 8.5% of the market, up from 8.0% this time last year. In unit terms, VW has also gained the most with 31,092 more cars sold than in 2022.

Sister brand Audi has registered 26,668 more cars than last year and MG has the third highest increase in volume, up 26,401 cars.

At the other end of the chart, Fiat is running down 2,767 units. Its sister brand DS is the second largest faller, down 1,245 cars, and Dacia is third with a drop of 829 cars.

Read our new car market analysis of October 2023 registrations

Select Fleet Solutions – Eton celebrates 25 years

Select Fleet Solutions – Eton Office, formerly Benchmark Leasing, is celebrating 25 years in the leasing broker sector

Wessex Fleet chooses MotorComplete broker platform for ARs

Wessex Fleet has selected the MotorComplete broker platform to provide websites for the Wessex Appointed Representatives (ARs)

New executive appointments in the fleet and leasing broker sector

There have been a raft of new appointments in the fleet and leasing broker sector, including the appointment of Ian Jeffery at PHVC

Broker News Awards 2024 in pictures

The Broker News Awards 2024 took place at the Orrery in London’s Marylebone. Here are the pictures to remember the event

Broker of the Year 2024 winner profile: Synergy Car Leasing

Synergy Car Leasing was voted Broker of the Year 2024 by the judging panel – here’s the winner’s profile supported by Leasing.com

Broker News Awards 2024 – the winners

The Broker News Awards 2024 – supported by Fleet Procure – produced outstanding winners, with Synergy taking the Broker of the Year title

Tristan Young is an award winning journalist with more than 25 years’ experience reporting on the automotive industry focussing predominantly on fleet and retail. As a self-confessed petrol-head, Tristan has a weakness for car classifieds. When he’s not writing about the automotive industry, he can usually be found outdoors with a small pack of border collies.