- BMW starts to challenge Tesla’s EV crown

- Ford sales continue to plunge

- 22 months of successive growth

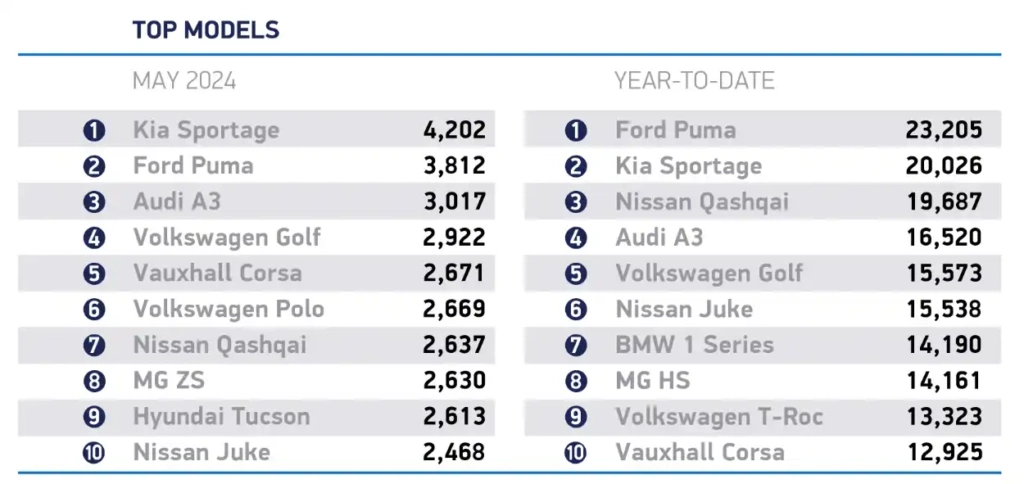

- Kia Sportage is number one selling car

WHO is winning at car sales? At one level, new car registrations don’t look too bad.

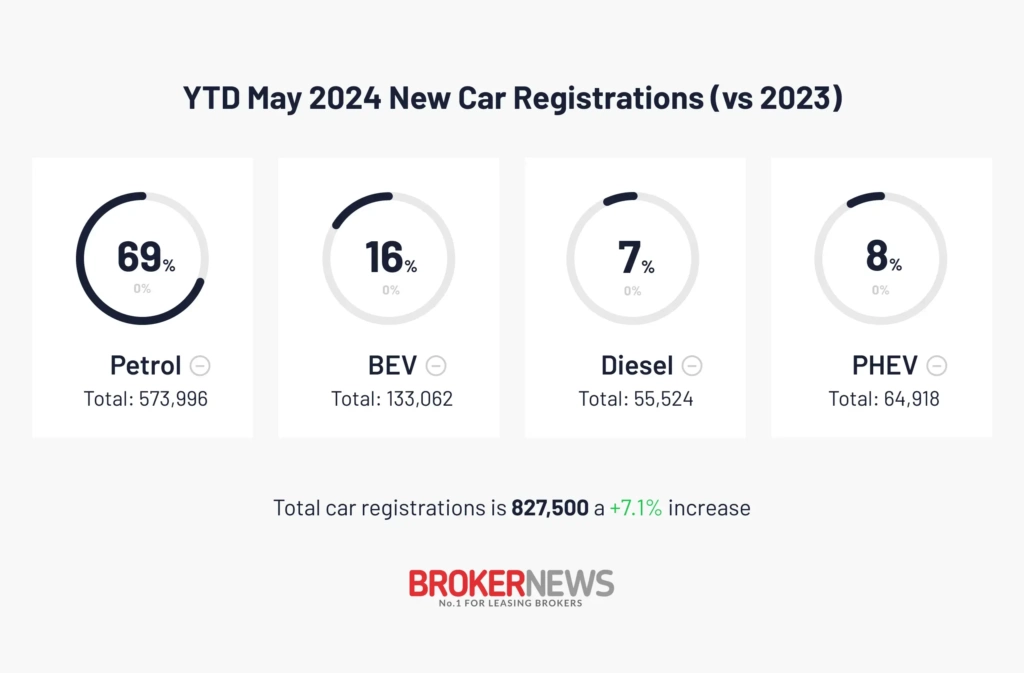

The market’s been positive for 22 successive months and year-to-date the UK’s up 7.1%. What’s more, the EV market looks strong, too.

Electric car numbers are up more than 11,000 so far this year and the market share now stands at 16.1%. If EV growth continues at its current rate, the ZEV Mandate should be achievable this year, according to data and lobbying firm New Automotive.

In contrast to New Automotive’s sunnier outlook for EVs, Philip Nothard, the Insight Director for Cox Automotive, was more cautious:

“Fleet sales primarily drove EV market share for the month, while private new car registrations remain, arguably, weak. That reflects a cautious buying public. However, manufacturers are relentless in their commitment to change. More than 100 EV models are on the market, and numerous tempting deals for consumers to go electric.

“However, the challenge of meeting the government’s 22% zero-emission vehicle mandate this year is significant and requires immediate attention.”

But, and it’s a big ‘but’, dig a little deeper into the numbers and we’re far from a consistently positive market in a highly complex and ever-shifting market.

A good illustration of this is that BMW is likely to overtake Tesla as the best-selling EV brand this year, according to data and pro-EV lobbying group New Automotive.

BMW was only 87 units off Tesla in May. However, this isn’t just down to BMW growth. Tesla continues to have a poor 2024. While its May was ‘only’ down 8.4%, for the year-to-date it’s down 12.6% which equates to more than 2,300 units off this time last year.

Similarly, Ford is having a shocking month and year despite the Ford Puma being the UK’s best-selling car this year.

In terms of units, Ford is the fastest falling brand.

Its May was down 3,450 cars on 2023 and year-to-date it’s now down 9,445 cars.

Its May was down 3,450 cars on 2023 and year-to-date it’s now down 9,445 cars.

A lack of EVs (Ford only has the Mach-E) won’t be helping company car sales. However, the new Ford Explorer (right) is due to launch in the UK before the end of the year, so that should help – but lack of a coherent model line up is certainly not helping.

Toyota, the second largest faller year-to-date, continues its downward trend. May was lower by nearly 18% and for the year it’s dropped 14%.

However, according to New Automotive, Toyota is on track to meet its ZEV Mandate target for electric cars. This is helped a great deal by CO2 improvements in its overall fleet which reduces its target from the maximum 22% to nearer 12% this year.

After a good start to the year, Stellantis is starting to have patchy results – some brokers we spoke to said that usual discounts seemed to be off the table.

May wasn’t a great month for the group with a fall of -3,872 cars. Year-to-date Stellantis is doing better due to a strong Peugeot performance. Peugeot is currently up more than 4,000 cars this year, but add all eight Stellantis brands together and it’s only up 3,639 cars. Vauxhall had a particularly poor month, down 2,853 cars.

Five fastest fallers YTD

Five fastest risers YTD

5 Tesla -2,335

4 Audi -2,497

3 Polestar -3,657

2 Toyota -6,555

1 Ford -9,445

1 BMW +15,605

2 Renault +9,464

3 Nissan +8,464

4 Mercedes +8,256

5 SEAT +4,537

Mixed signals from an EV market on the move

There’s also contrasts within electric vehicle sales too.

New electric car sales climbed 6.2% in May, according to the latest official figures from the SMMT. The rise outperformed the overall market and as a result the market share for electric cars rose to 17.6%, up from 16.9% last year.

The growth in electric was driven by company car sales which were up 10.7%. Private electric car sales, however, fell 2.0% in May.

Over the first five months of 2024, electric cars now account for 16.1% of the new car market, up from 15.7% a year ago.

Plug-in hybrids are doing even better with a growth of 31.5% so far this year and now account for 7.9% of the market, up from 6.4% a year ago.

Retailers have reported to Broker News that car manufacturer offers on EVs have been inconsistent. This lack of consistency has made it difficult for dealers to attract buyers with clear offers to go electric. One dealer added that when electric car offers are clear and obvious to customers, they are able to sell to private buyers.

Source: SMMT

Outlook as we head towards end H1

While the overall market in May was up 1.7%, the 22nd consecutive month of growth, the month’s 147,678 car market is still well below that of the pre-pandemic years.

The fleet and business sectors are supporting the total in this two-speed car market. Private registrations only account for 38% of the market. Retail buyers aren’t yet interested in electric cars to any great extent and that part of the market was in reverse in May, down 2%. Retail overall this year is down 11.3%.

While a booming company car market is great for brokers operating in the non-regulated sector of the market, with an election a month away, you have to ask the question: what will the next government do in terms of incentives for the regulated sector?

While many are talking about the levelling up of EV incentives so that retailer buyers are on a level playing field with fleet. But what if any change negatively impacts the company car market?

Read our new car market analysis of April 2024 registrations

Fleet Alliance backs Women in Broking Live! networking event

Fleet Alliance is backing Women in Broking Live! as part of its sustainable mobility strategy to encourage greater diversity

Broker News Awards 2024: Best SME Broker, Vavoom Leasing

The Best SME Broker award 2024 was won by Vavoom Leasing – here’s our winner’s profile in association with Leasing.com.

BNP Paribas and Arval UK provide finance for Chinese Chery brands Omoda and Jaecoo

OEM brands Omoda & Jaecoo will enter the UK market in partnership with BNP Paribas Personal Finance UK and Arval UK

Strongest June for RVs since 2009

June used car values were the strongest since June 2009, says cap hpi, with petrol cars proving most popular with consumers.

DriveElectric delivers salary sacrifice to Norton Motorcycles

Norton Motorcycles is offering staff the chance to drive EVs via a salary sacrifice programme from EV specialist broker DriveElectric.

Broker News Newsletter 25 June 2024

Catch up on the latest leasing broker news in the 25 June 2024 Broker News newsletter

Fleet Alliance backs Women in Broking Live! networking event

Fleet Alliance is backing Women in Broking Live! as part of its sustainable mobility strategy to encourage greater diversity

Broker News Awards 2024: Best SME Broker, Vavoom Leasing

The Best SME Broker award 2024 was won by Vavoom Leasing – here’s our winner’s profile in association with Leasing.com.

BNP Paribas and Arval UK provide finance for Chinese Chery brands Omoda and Jaecoo

OEM brands Omoda & Jaecoo will enter the UK market in partnership with BNP Paribas Personal Finance UK and Arval UK

Strongest June for RVs since 2009

June used car values were the strongest since June 2009, says cap hpi, with petrol cars proving most popular with consumers.

DriveElectric delivers salary sacrifice to Norton Motorcycles

Norton Motorcycles is offering staff the chance to drive EVs via a salary sacrifice programme from EV specialist broker DriveElectric.

Broker News Newsletter 25 June 2024

Catch up on the latest leasing broker news in the 25 June 2024 Broker News newsletter

Tristan Young is an award winning journalist with more than 25 years’ experience reporting on the automotive industry focussing predominantly on fleet and retail. As a self-confessed petrol-head, Tristan has a weakness for car classifieds. When he’s not writing about the automotive industry, he can usually be found outdoors with a small pack of border collies.