Discounting by Mercedes helps agency-led brand bolster market position

0% finance and more than £8k discounts have helped

EV registrations still strong despite government announcement

Stellantis: ongoing gravity pull continues

CONCERTED discounting by Mercedes in September has seen the brand recover its position and is now up in terms of units sold on 2022. However, Mercedes’ growth, sitting at 2.37% for the year-to-date, is still well below the total market increase of 20.2%. As a result, the manufacturer’s market share has fallen from 5.4% at this point last year, to 4.6% now.

It should also be highlighted that at this point in 2019, ahead of the pandemic supply constraints, Mercedes had registered more than 140,000 cars and had a market share of more than 7.5%.

For the year-to-date 2023, Mercedes has registered 66,901 cars.

With Mercedes retailers, who were moved to the agency model at the start of the year, reporting the manufacturer has too many large and expensive EVs which are difficult to sell and not enough A- and B-class which are popular, Mercedes has begun offering significant offers on its EVs.

Broker News has seen one offer for the EQC advertising a £8,600 price cut and 0% finance (main picture).

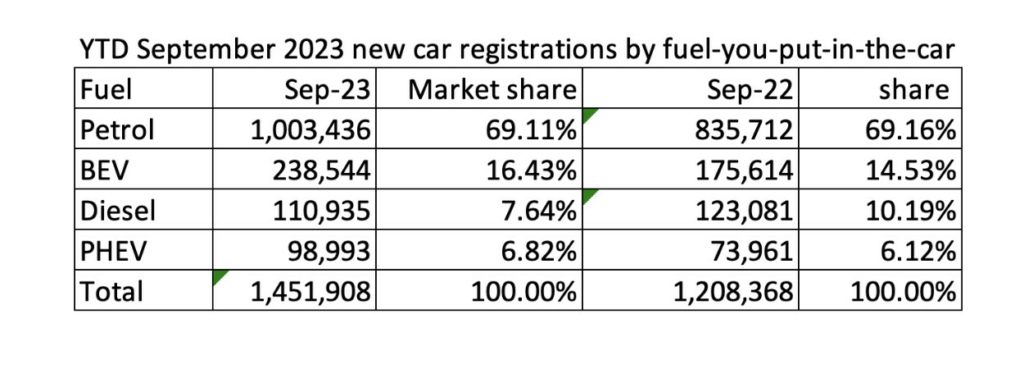

Share of market by fuel type

Despite several government announcements on the future of electric vehicles, including the moving of the petrol and diesel ban deadline to 2035, causing uncertainty in the market, EV growth and total numbers are currently up year-to-date.

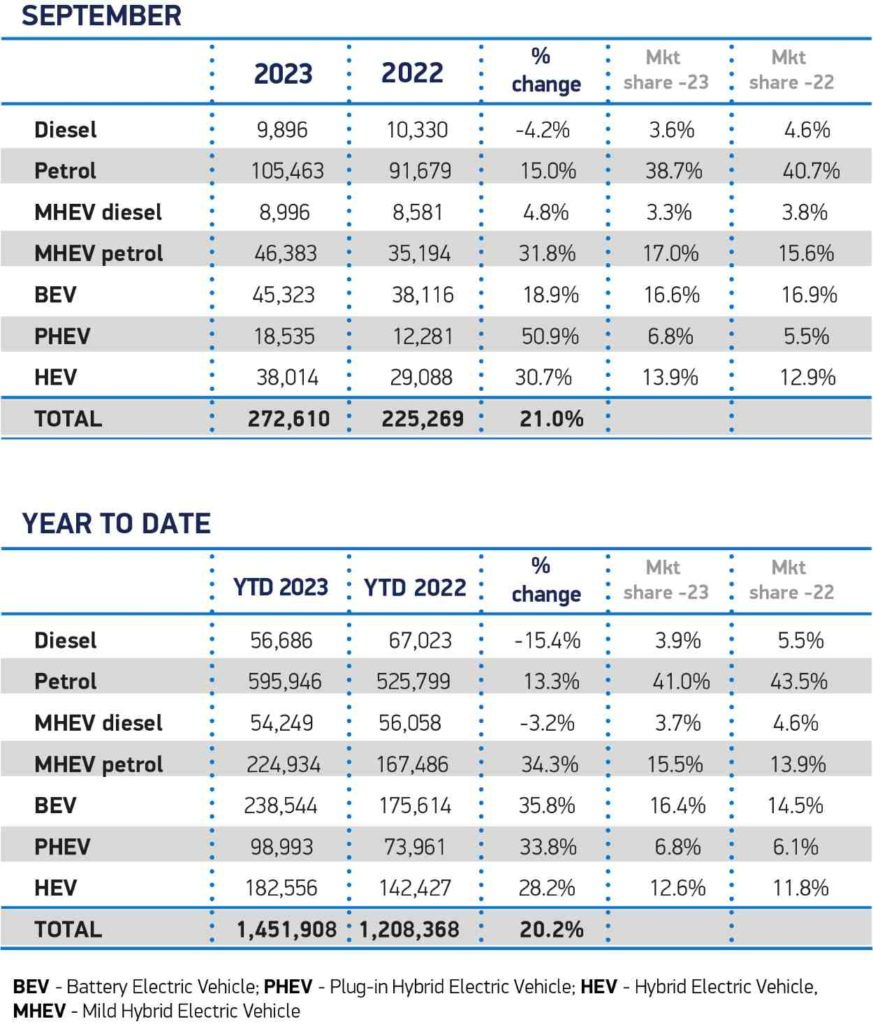

Total new car registrations were up 20.2% on last year for the first nine months of 2023 with electric car sales up almost 36%, accounting for 16.4% of the market. A year ago, that figure was 14.5%.

However, comparing September 2022 with this month’s figures show the percentage mix dropped fractionally from 16.9% to 16.6%.

Commenting on the latest figures from the SMMT, Nick Williams, managing director, Lex Autolease, part of Lloyds Banking Group, said:

Moving forward on phasing out the sale of new petrol and diesel cars and vans between 2024 and 2030 will provide consumers and businesses with the certainty needed to switch to EVs. That confidence coupled with the new registration plate release is reflected in strong September figures from the SMMT, which saw a further 272,610 new vehicles join the UK’s roads.

I’m hopeful that the delay on the final phase out date won’t impact these figures in the coming years, as renewed commitments from manufacturers and businesses looking to hit their own carbon targets will help to drive continued growth.

The revised deadline and the commitment to the ZEV mandate provides both clear, long-term policy support and the appropriate sense of urgency and should ensure industry, businesses and consumers can continue to plan effectively for an electric future.

Nick Williams, managing director, Lex Autolease

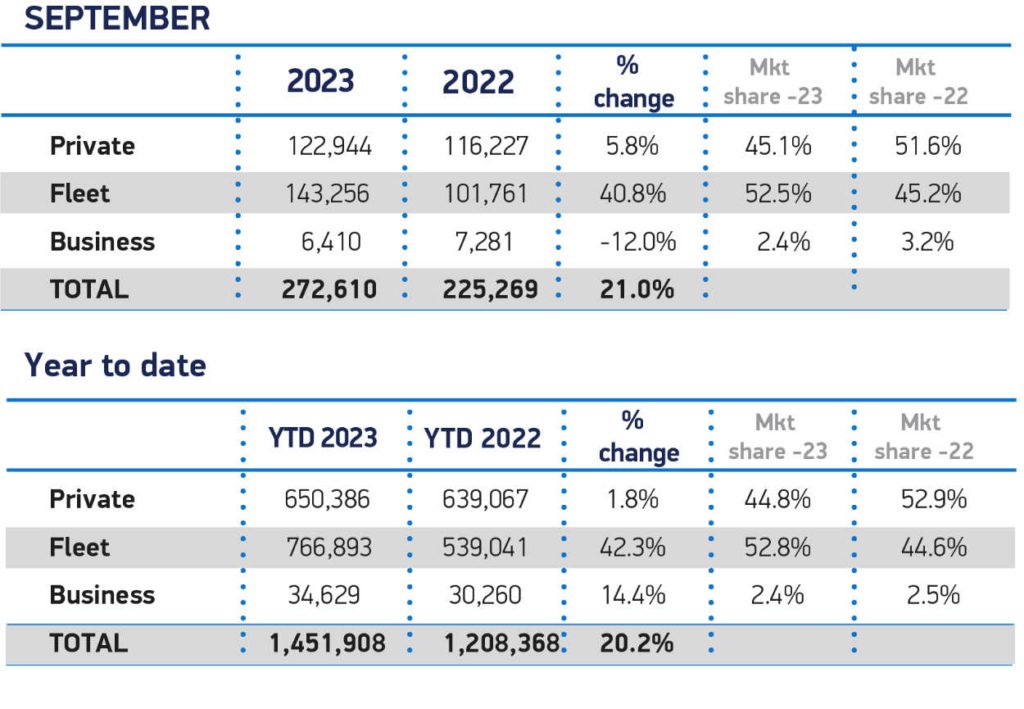

Total market: business still in the driving seat but retail shows signs of coming to life

While company car registrations accounted for the majority of the rise in September, up 40.8%, private sales were up 5.8% (read: The Leasing.com PCH temperature check: September 2023).

Retailers and industry commentators have highlighted that while fleets account for the majority of electric vehicle registrations, a significant increase in discounts and finance offers for private electric car buyers has helped sales.

These offers have countered confusion over the government’s plans for electric cars, according to one dealer. They added there were a large number of high-priced electric cars in stock which were proving difficult to sell to private buyers, but not enough lower-cost electric cars which did sell well.

Other retailers who spoke to Broker News also pointed out that while the figures were up significantly on 2022, they are still significantly down on pre-pandemic numbers. With one retailer adding: “If September was at school, its report would read ‘must try harder’.”

Stellantis - still trending downwards

Stellantis, which has the aim of hitting a 20% market share (including cars and vans by 2025), is continuing to see its share of the car market fall.

This time last year its combined brands accounted for 12.6% of the new car market. Today the car brands make up 11.3% of the market.

While Vauxhall is performing well in unit terms, and is up nearly 10,000 year-to-date, the growth is still below that of the market average. The same applies to Peugeot and Citroen. Alfa Romeo, DS, Fiat and Abarth are all down on 2022 figures.

Read August 2023 new car sales analysis

Select Fleet Solutions – Eton celebrates 25 years

Select Fleet Solutions – Eton Office, formerly Benchmark Leasing, is celebrating 25 years in the leasing broker sector

Wessex Fleet chooses MotorComplete broker platform for ARs

Wessex Fleet has selected the MotorComplete broker platform to provide websites for the Wessex Appointed Representatives (ARs)

New executive appointments in the fleet and leasing broker sector

There have been a raft of new appointments in the fleet and leasing broker sector, including the appointment of Ian Jeffery at PHVC

Broker News Awards 2024 in pictures

The Broker News Awards 2024 took place at the Orrery in London’s Marylebone. Here are the pictures to remember the event

Broker of the Year 2024 winner profile: Synergy Car Leasing

Synergy Car Leasing was voted Broker of the Year 2024 by the judging panel – here’s the winner’s profile supported by Leasing.com

Broker News Awards 2024 – the winners

The Broker News Awards 2024 – supported by Fleet Procure – produced outstanding winners, with Synergy taking the Broker of the Year title

Tristan Young is an award winning journalist with more than 25 years’ experience reporting on the automotive industry focussing predominantly on fleet and retail. As a self-confessed petrol-head, Tristan has a weakness for car classifieds. When he’s not writing about the automotive industry, he can usually be found outdoors with a small pack of border collies.