Tristan Young is an award winning journalist with more than 25 years’ experience reporting on the automotive industry focussing predominantly on fleet and retail. As a self-confessed petrol-head, Tristan has a weakness for car classifieds. When he’s not writing about the automotive industry, he can usually be found outdoors with a small pack of border collies.

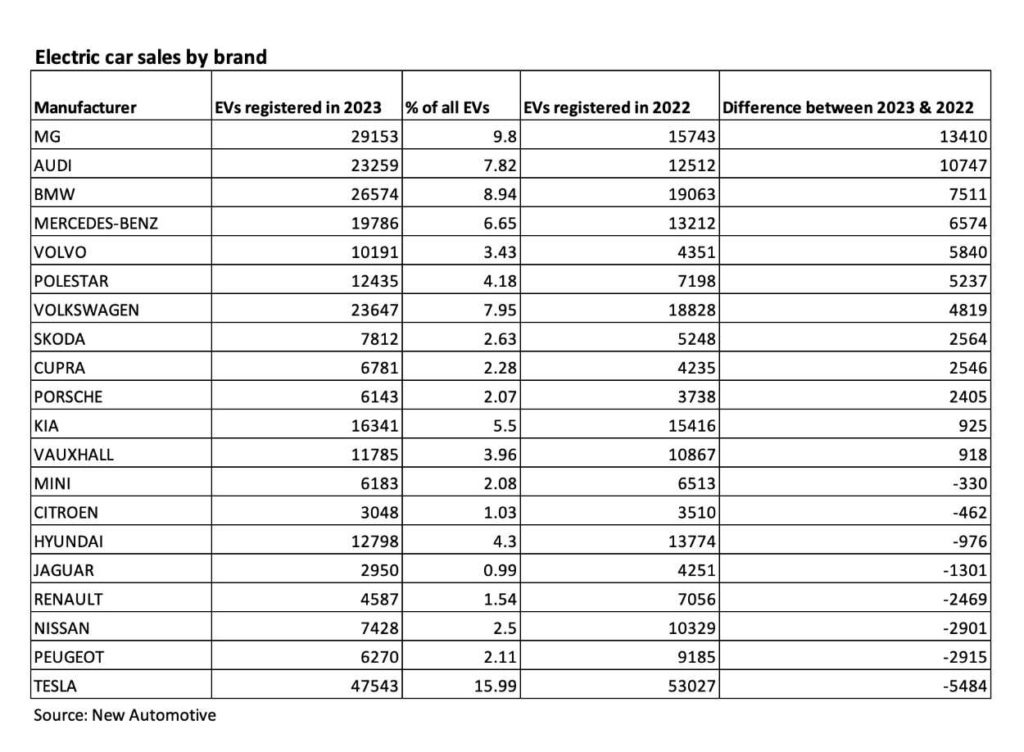

The vast majority of the Mercedes increase in registrations last year was down to its electric car range which saw a 6,574-car increase over the previous year.

The vast majority of the Mercedes increase in registrations last year was down to its electric car range which saw a 6,574-car increase over the previous year.

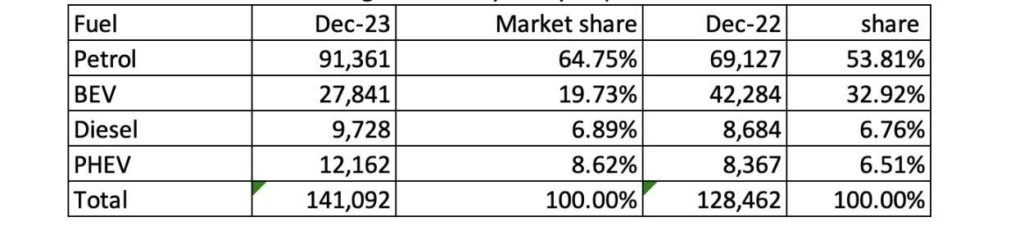

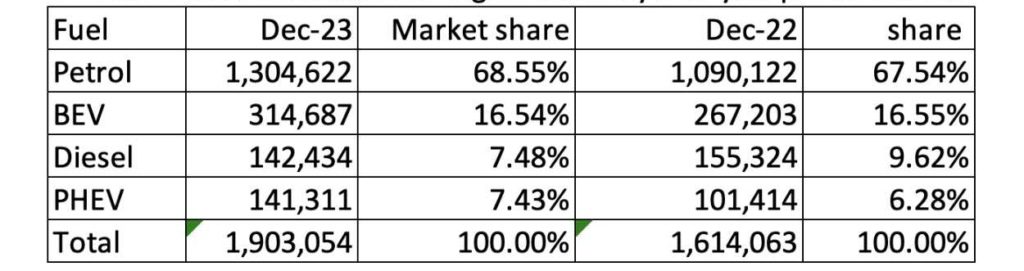

“Last year marked a slowdown in the UK’s transition to electric vehicles with the proportion of sales falling significantly below the 2024 ZEV mandate, despite volumes exceeding prior years.

“Last year marked a slowdown in the UK’s transition to electric vehicles with the proportion of sales falling significantly below the 2024 ZEV mandate, despite volumes exceeding prior years.