THE growth of personal contract hire has been spectacular – the BVRLA’s latest leasing statistics show that broker-driven personal leasing is at +23% against a declining business contract hire market.

But with this growth comes an increasing regulatory threat believes Karima Haji (above), director of Auto Novo, a change practitioner in the automotive sector.

“The issue is over treating customers fairly,” commented Haji.

“And the regulators will say that if you sell PCH then you will need to have controls in place. The captives are heavily regulated already and if a dealer mis-sells the FCA will come down heavily, as we have already seen. But in the broker area it is more fluid

“So I think it will come down to how you control brokers treating customers fairly when they are selling retail contract hire. Can the customer afford the monthly rentals, but can they also afford to service and maintain the vehicle? I think that will be a crucial question that the FCA will want regulated in the future.

“Will we see more PCH with maintenance starting to appear as a result? I think we will and we probably should. Condition of vehicle at end of lease will become critical.”

The FCA in its Assessing creditworthiness in consumer credit, said:

“We want firms to make a reasonable assessment, not just of whether the customer will repay, but also of their ability to repay affordably and without this significantly affecting their wider financial situation. This should minimise the risk of financial distress to customers.”

The leader in the PCH market, Manchester-based broker Nationwide Vehicle Contracts, is already taking a lead on this.

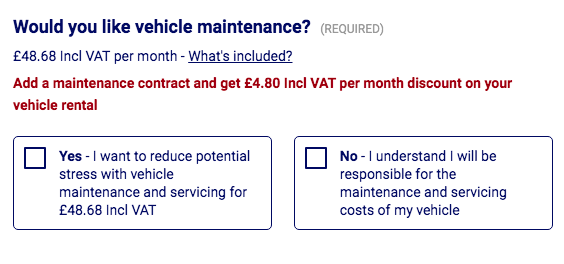

For all its online quotations, the website offers PCH customers the opportunity to take maintenance for a discount on the monthly rental. And before proceeding to finance and ordering, consumers must either opt in or opt out of maintenance with a clearly stated choice – this is from their website:

“To be honest, the funders we work with have already factored much of that in on their proposal acceptances,” commented Keith Hawes, director, Nationwide Vehicle Contracts.

“Firstly we would not forward prospects with evidence of a poor credit profile hence we have an 86% acceptance rate on our proposals. The remaining 14% tend to be business customers who don’t have the full two year set of accounts, customers who have minor transgressions on their credit history or factors that the funder sees which they believe could lead to affordability issues.

“Meanwhile, our default rates on PCH are miniscule which suggests that where credit is approved affordability is not an issue.”

OEMs forcing PCH as route to mobility subscriptions

Haji, who is on the board of subscription provider Wagonex, also believes that OEMs are keen to push the retail contract hire sector because it’s a small step from a rental to a fully inclusive mobility subscription.

“I believe OEMs are pushing PCH because it’s an easy step to a mobility product. The consumer is already used to a rental and a subscription is a small step beyond that. For customers on a PCP, however, it’s a much greater leap into a mobility subscription product.”

A report by research company Technavio supports this view. It suggests that car subscriptions will grow by a compound annual growth rate of 71% towards 2022.

Technavio said:

“The traditional pay-per-product model is being replaced slowly by subscription economy, which offers goods and services on a subscription basis. This practice is spreading to most of the business verticals such as consumer electronics, fashion products, furniture, music, and automotive.”

OEMs already providing subscription services in the UK include (pictured above) Jaguar Land Rover (Carpe), Care by Volvo, and Lexus One.

Meanwhile funder LeasePlan has Subscribe & Drive. Independent subscription providers include Drover and Wagonex.

A subscription service would remove issues of treating the customer fairly as maintenance is part of the all-inclusive package. However, this would be at the expense of low monthly rentals which is the current driver of personal contract hire.

As the sector develops, consumers may end up with a choice of strictly regulated PCH, PCH with maintenance, and full service PCH under the guise of a subscription service.

Ralph Morton is the leading journalist in the leasing broker sector and editor of Broker News, the website which provides information and news for BVRLA-registered leasing brokers. He also writes extensively on the fleet and leasing market in both the UK and Europe.